NIFTY should take support around 10000-10100 levels.

Indian equities are in the bear grip since the time it was last cautioned through our column “Caution ahead” dated 29th Jan 2018. Since then NIFTY has fallen by over 750 points from 11130 (29th Jan 2018). The fall was even steeper in the mid and small cap stocks. The BSE Midcap and BSE Small Cap indices have fallen by 10.6% and 11.6% respectively from their highs as against 6.7% fall in NIFTY. It needs to be noted that midcap and smallcap indices made highs about 2-3 weeks before NIFTY made its top.

Even after precipitous fall, there is still no confidence on the street. Corrections in the bull markets are usually sharp and swift. They create blood all over the street, but don’t last very long. On the brighter side, they improve the technical strengthen for the next up-move. Indian equities are currently undergoing similar corrective phase.

The Union budget announced on Feb 01, 2018 acted as a trigger point for the start of this corrective move. The correction can be attributed to a mix of domestic and global factors. On the domestic front, introduction of long term capital gains tax, slippages on fiscal deficit front, aggressive budgetary allocation towards social welfare programs, elevated crude prices, rising inflation etc. have created uncertainty leading to this correction in the markets. The Rs11400 Cr fraud at PNB has further soured sentiments as investors are concerned about the quality of checks and controls in the Indian banking system and the risk of contagion spreading into the entire banking system.

On the global front, risk-off in the global financial markets created panic among FIIs. The aggressive commentary by the Fed on the future growth prospects and possibility of faster-than-expected interest rate hikes in the U.S. added fuel to fire.

The hardening of bond yields over last few months have resulted in rising cost of capital, thereby putting pressure on the stretched valuations of the Indian equities. NIFTY is now quoting at P/E of over 25 times as per data available on NSE website, still at a premium to other emerging markets.

Let’s do a reality check. Have the fundamentals deteriorated to an extent that it merits underweight stance on India? The lack of checks and balances in the Indian banking sector will surely be addressed by the regulators and the government by bringing in more stringent regulatory environment. The situation is not as grim as sentiment on the street suggest.

The resolution of top 12 bad accounts which were referred to NCLT under IBC are in the advanced stages of resolution. This will bring back over Rs1-lakh crore of fresh liquidity for the banks. There is tremendous interest in the distressed assets as is visible from the aggressive bid made by Tata Steel for Bhushan Steel.

The Dec-2017 quarter results too have come above expectations. There were more hits than misses, suggesting corporate earnings are improving. The investment cycle is surely picking up.

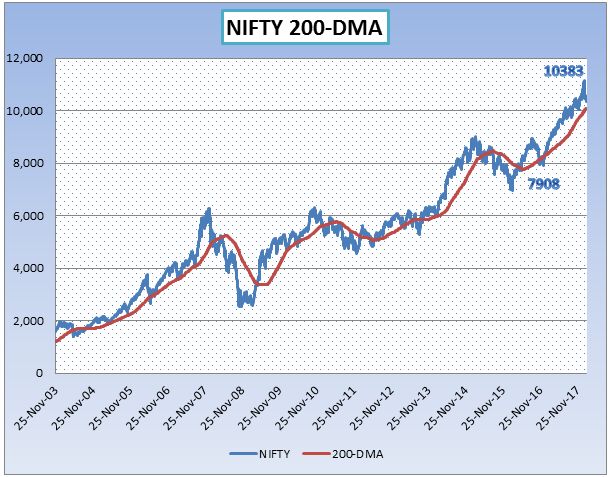

Historically it is seen that 200-DMA acts as a strong support for the markets. NIFTY has not seen any meaningful corrections since end of Dec 2016 when it last crossed 200-DMA, after hitting lows of 7908 on 26th Dec 2016. Since then it has moved up by over 3200 points, a massive 40% gain in the span of just 13 months. The correction has improved strength of the markets for the next up move.

The 200-DMA for NIFTY currently stands at around 10092, about 2.8% from the current levels. Similarly BSE midcap and BSE small-cap indices too are just about 2%-5% away from their 200-DMAs. This 200-DMA should act as a strong support zone for the markets. The risk reward is again turning attractive for fresh investments. It would be interesting to see if Indian market holds on and makes a reversal from this magic level.

Disclaimer: The views expressed in this article are personal and the author is not responsible in any manner for the use which might be made of the above information. None of the contents make any recommendation to buy, sell or hold any security and should not be construed as offering investment advice.