The decade long super cycle for crude has come to an end

Globally, the fluctuation in crude oil prices is an important barometer on the economy. Therefore, the prices of crude oil are tracked very closely by investors the world over. The gyrations in crude oil impact the sentiments of stock markets all over the world. The rise in crude oil prices is not good for the global economy. Price rise in crude oil impacts everyone, industries and consumers. Rising oil prices translate into higher energy prices, rising cost of producing goods, etc.

The period starting 2002-2003 was the beginning of the super cycle for commodities driven by an increase in demand from emerging economies like China and India. In China demand was driven by the infrastructure development supporting the 2008 Olympics. This created a spurt in global commodity prices including crude oil, which increased from around $25 per barrel at the start of 2003 to over $130 per barrel in mid-2008, a few months before the Lehman brothers went bust.

The trend of rising commodity prices was temporarily arrested post the US sub-prime crisis of 2008 when the prices of various commodities corrected sharply due to panic in world economies. The price of the benchmark, Brent Crude fell sharply to around $40 per barrel by the end of 2008. However, announcements of various rounds of Quantitative Easing (QE) by various western economies such as the US and Europe, followed by the geo-political crisis in the Middle East resulted in speculative inflow of excess liquidity into commodities driving commodity prices higher despite the less than proportionate increase in demand. Even emerging economies such as India, which were considered resistant to the economic downturn, experienced a slowdown due to rising inflationary pressures. The inflationary pressure in India could be partly attributed to the higher price of commodities such as crude oil which is, to a large extent, imported by the country. The price of Brent Crude rose from lows of $40 per barrel in December 2008 to $125 per barrel in March 2012.

Currently, starting mid-April 2013, the price of various commodities, including crude oil, is on a downward spiral. Commodity prices, which were driven primarily by speculative forces, have reversed sharply; crude has fallen from around $115 per barrel to just over $100 per barrel.

The US, which is one of the largest consumers of crude oil, and accounts for over 20 per cent of the world’s consumption, is experiencing a fall in demand due to the severe economic slowdown. The consumption of crude oil has fallen from 18.95 MMbbl/d in 2011 to 18.55 MMbbl/d in 2012 and is expected to increase only marginally to 18.63 MMbbl/d till 2014.

On the other hand its production, which averaged 6.5 MMbbl/d in 2012, is expected to average 8.17 MMbbl/d by 2014 as per the Short Term Energy Outlook (STEO) released by the US Energy Information Administration (eia; released 7 May 2013). The net import of crude oil by the US is on a steady decline, falling from around 9.75 MMbbl/d in 2008 to 7.6 MMbbl/d in 1QFY 13. STEO forecasts net imports to fall further to 6.33 MMbbl/d by 4QFY 14. Even an ample supply of shale gas in the US could partly replace demand for crude oil and keep a lid on crude prices in the years to come. All these factors point to a sufficient supply amidst slowing consumption, keeping prices under check. Considering the fundamental factors affecting crude oil prices going forward, we feel the decade long super cycle for the commodity has come to an end.

Brent Crude, which averaged $112.48 in 1QFY 13, is forecasted to be around $99 per barrel by 4QFY 14 as per steo. We feel prices could remain range bound with negative bias and see a time wise correction in the years to come providing strong impetus to growth for developing economies like India which are dependent on imported crude.

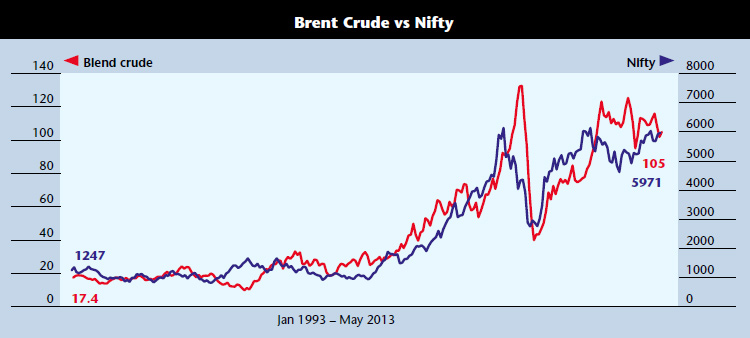

In a Business India article (dated 14 October 2012) we wrote that crude prices and equity markets are positively correlated. This was backed by long-term historical time series data starting 1993. The simple logic behind positive correlation was that the performance of equities (considered a barometer for economic growth) is linked to economic growth; and same is the case with demand for crude oil. However in the past few years, the price of commodity increased due to speculative demand. This seems to have come to an end. Going forward, for the next few years, we believe the trend is about to change. The initial glimpse of the upcoming trend is clearly visible (see charts). The correction in the price of crude (time-wise or price-wise) will change the macro fundamental factors for India, which will drive Indian equities higher. We strongly believe Indian equities will hit new highs in the time to come.

This article was originally published in Business India Magazine.

Write to us at news@valuelineadvisors.com

Disclaimer: The views expressed in this article are personal and the author is not responsible in any manner for the use which might be made of the above information. None of the contents make any recommendation to buy, sell or hold any security and should not be construed as offering investment advice.