NIFTY50 closes above 200-WMA– Will it sustain this liquidity-led push?

Global equities are presently witnessing one of the strongest bull-runs ever, even as fundamentals continue to be on shaky grounds. Indian equities too are riding with the tide. The global liquidity flow continues to drive markets higher. NIFTY50 has comfortably closed above the 200-WMA and is now facing resistance near 200-DMA which stands around 10,885 levels. Technically, the crossing of 200WMA is a bullish sign and bulls are trying hard to continue the momentum. As frontline index stocks face resistance, midcap and small cap stocks have started catching this momentum.

The ongoing market rally is primarily driven by the global liquidity push in addition to periodic positive announcements. There are more than 145 Covid vaccines under development across the world and 21 vaccines are in human trials. Bharat Biotech, an Indian vaccine-maker has received regulatory approval to start human clinical trials for its experimental shot, sparking positive market sentiments. The pullback of Chinese troops from the Galwan Valley clash site in Ladakh has helped in the de-escalations of tensions between India and China. Reliance Industries – one of the NIFTY heavyweights – has been one of the biggest drivers of this rally on the back of multiple investments in its digital services subsidiary, JIO Platform. This heavyweight has doubled since the lows of March 2020.

June numbers have seen strong revival, but this could primarily be attributed to pent-up demand after three months of nationwide lockdown. Even though monthly auto sales numbers have seen a rising trend in June, they are still much lower than pre-Covid levels.

The sharp 43 per cent rally in the NIFTY50 from the March 2020 lows of 7,511 to around 10,800 has taken investors by surprise. Most investors continue to remain skeptical about the sustenance of this rally as the global economy continues to face economic headwinds. The Indian economy, too, is facing the risk of a long recession ahead.

Most companies today are unable to provide earnings guidance. The demand environment continues to remain subdued as consumer spending remains weak. Job losses and salary cuts have become a common phenomenon. In such an environment, the revival of consumer spending in the near term seems to be a difficult task. These are unprecedented times and entire world is adversely affected by COVID-led disruptions.

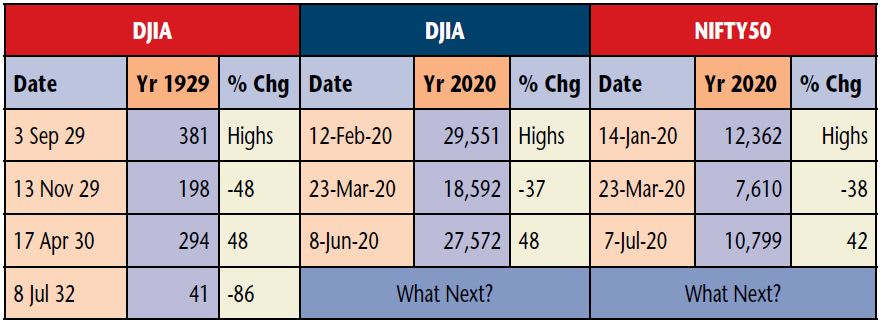

The closest resemblance to the ongoing disruption is the Great Depression of 1929. The Great Depression, which started with the crash of October 1929, was the largest financial crisis of the 20th century. Prior to the crash, the Dow Jones had risen ten-fold in nine years to reach highs of 381 in early September 1929. The market crash of October 1929 nearly halved the index to an interim low of 198 by November 1929. Since then the markets resumed its uptrend, reaching a secondary closing peak of 294 by mid-April 1930 (bear market rally). A long and steady slide then started, from April 1930 to July 1932, when the index closed at 41, its lowest levels of the 20th century, concluding an 89 per cent loss for the index in less than three years. Interestingly, the index did not return to the peak closing of September 1929 until November 1954.

Is the ongoing momentum in global equities just a bear market rally or a major change in trend? Or will global equities see a major decline as was seen during The Great Depression of 1929?

The technical indicators for the NIFTY50 are now in the bullish zone but have started looking over-bought. As per one of the blogs, the percentage of emerging market stocks that are over bought with RSI above 70 is at its second-highest levels ever. The NIFTY50 P/E has moved higher from 18x in March to 28x now, reaching pre-Covid levels. As future earnings look increasingly uncertain, forward valuations look extremely stretched for this rally to gain further grounds.

It needs to be seen whether bulls will be able to fight out technical resistances or whether bears will be able to put a break to this dream rally. It is time to be cautious as there could be a strong tussle between the bulls and the bears. 200-WMA should now act as a strong support for the bulls.

This article is to be originally published in Business India Magazine.

Write to us at news@valuelineadvisors.com

Disclaimer: The views expressed in this article are personal and the author is not responsible in any manner for the use which might be made of the above information. None of the contents make any recommendation to buy, sell or hold any security and should not be construed as offering investment advice.