Oil not to derail rally.

As mentioned in our column in Business India (issue dated 26 March), the NIFTY has reversed its trend from around 10000 levels, which acted as a strong support. Since then the NIFTY has moved up sharply by 650 points in just 17 trading sessions, a rise of 6.5 per cent from the recent lows. It has already recovered 50 per cent of the fall. The recent sharp correction has improved the technical strength of the markets. Markets are on their way up, ready to touch new highs in the months to come.

However, investors still look worried about several factors – such as rising geo-political issues, trade war between world’s two largest economies, rising crude prices, changing political dynamics in India, etc. These fears look exaggerated, in light of the strength of economic recovery.

The fear of derailment of an ongoing bull-run in Indian equities due to continuous rise in crude prices is unfounded. The rise in crude prices is due to multiple global factors. The ongoing geo-political issues, improving global demand, fall in inventory levels and production cuts by the opec in the run up to the ipo of world’s largest oil & gas company have kept crude prices elevated in the near term.

These issues are expected to have a limited impact in the long run. The higher price is steadily bringing back additional production as is reflected in unexpected rise in inventories. The ongoing trade war between world’s two largest economies is seen as potentially denting demand growth.

There is general perception that India being a net importer of crude will be adversely affected by rise in crude prices. This is partly true, but it is unlikely that crude prices will move further up from the current levels as Saudi officials too have shown their satisfaction with the current dynamics of global oil market. The crude prices are expected to remain range bound with limited upside from the current levels.

Off late the Indian government has been proactively taking strategic steps keeping in mind India’s dependence on imported oil. It has recently offered a 50 per cent strategic stake to Saudi Aramco in the proposed $44 billion refinery-cum-petrochemicals project. This initiative is expected to provide strategic benefits to both the countries. India has also recently started importing lng from the US as part of a 20-year-agreement with US major Cheniere Energy.

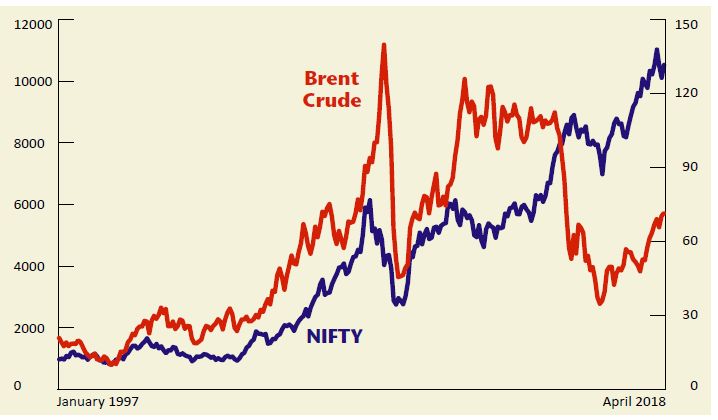

Investors fear that rising oil prices could derail ongoing rally in the nifty. But if one looks at the historical movement in the nifty and crude prices, and establishes a correlation between the two, this fear is clearly unfounded. There is no clear negative correlation between the two – and if at all anything, it is positive correlation (see chart).

IIP grew 7.1 per cent in February primarily driven by capital goods (which grew 20 percent), infra/construction (12.6 per cent), and manufacturing activities (8.7 per cent), suggesting a strong pick-up in investment activity amid higher industrial output. Consumer inflation too has moderated to five month low of 4.28 per cent, while wholesale inflation has come down to 2.47 per cent, despite the rising crude prices, providing a double boost to the economy. This has reduced the possibility of an interest rate hike by the RBI in the near term. Corporate earnings are expected to continue its growth momentum of the previous quarter. Advance tax collections, speedy resolution of NPAs under IBC, a favourable monsoon forecast by IMD – all augurs well for the India growth story.

However, in the short term the ongoing earnings season and the upcoming state elections in Karnataka will have some impact on market sentiment. The overall trend is expected to remain positive for Indian markets.

This article was originally published in Business India Magazine.

Write to us at news@valuelineadvisors.com

Disclaimer: The views expressed in this article are personal and the author is not responsible in any manner for the use which might be made of the above information. None of the contents make any recommendation to buy, sell or hold any security and should not be construed as offering investment advice.