NIFTY50 unlikely to cross 200-week moving average

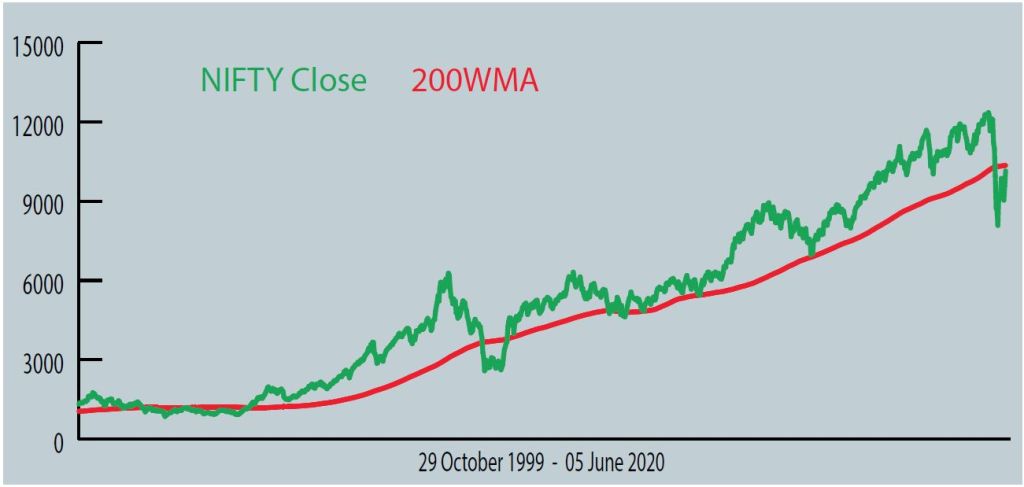

In technical analysis 200-Day Moving Average (200-DMA) is used to analyse and identify general market trends. It represents average price of the underlying stock/index over the past 200 days (roughly 40 weeks). There is an even more important 200- week moving average (200-WMA) which represents average price over a 200 week period (roughly four years). It is considered the ‘mother of all moving averages’. It signifies major long-term trend changes. This average doesn’t get broken easily, but once broken decisively on a weekly closing basis, it takes very long to reverse the trend. We have written about this 200-WMA multiple times in the past as it holds tremendous significance.

NIFTY50 had broken 200-WMA in the week of 13 March 2020 and since then there has been a bloodbath in Indian equity markets. NIFTY50 had fallen sharply from the highs of 12430 on 20 January 2020 to lows of 7511 on 24 March 2020, a fall of 40 per cent in just over two months. NIFTY50 is now back with a bang rising over 2650 points (~35 per cent) from March 2020 lows, driven solely by huge global liquidity. Most of the global indices have recovered more than 50-60 per cent from their lows. Nasdaq hit all-time highs of 10000-mark for the first time ever. The United States as well as other major economies across the globe has infused huge liquidity to support their ailing economies.

The 200-WMA for NIFTY50 currently stands at around 10350 levels, while NIFTY50 is currently trading around 10167 (as of 8 June closing). Indian markets are again inching closer to this important mark. Do fundamentals of Indian economy really support this trend reversal, or is it just a liquidity rally driven by global factors?

Businesses in India have suffered huge disruptions due to the lockdown. There is still no clarity on the way ahead. These are times where there is clearly no precedence of how economy will perform going ahead.

The government has announced relaxation of lockdown and phase wise opening up of economy as part of Unlock 1.0. This is a major step taken in the right direction after country-wide lockdown of past few months. But this move too is not free from operational challenges. The major economic drivers are densely populated metro cities which also happen to be major Covid -19 hubs and hence continue to operate with government restrictions. These hubs continue to struggle to bring life back to normalcy as government has curtailed public transport support making it difficult for people to travel. India Inc is facing huge shortage of skilled labour as large numbers of migrant labourers have left for their hometowns during the lockdown period. It is going to be daunting task to bring these workers back to work amid ongoing uncertainty.

The World Bank has now forecasted Indian GDP to shrink by 3.2 per cent in FY21, with more downside risks and threat to growth. India’s Tax to GDP ratio has fallen to 9.88 per cent in FY20 – the lowest in the last 10 years. Collections are expected to remain even lower this year. Macro fundamentals of the Indian economy continue to remain weak.

Moody’s has downgraded India’s sovereign ratings citing sustained loss of economic growth momentum, worsening government finances, and weak implementation of economic reforms since 2017 as key reasons. With expected fall in corporate earnings in near to medium term, the current NIFTY levels looks stretched. The ongoing geopolitical developments involving US, India, China, Pakistan also points to impending risks in the near term.

The last time NIFTY50 had broken 200-WMA decisively was during the market crash of 2008-09 – during the sub-prime crisis and Lehman moment. Then NIFTY had broken 200-WMA in October 2008 and regained it back in mid-May 2009. It took NIFTY50 about 29 weeks (~7 months) to regain the 200-WMA mark. Since then Indian markets have taken support around 200-WMA multiple times and marched forward on its upward journey.

It needs to be seen how long it takes for NIFTY50 to decisively cross 200 WMA this time. Will this current rally sustain and gain further ground or will it eventually fizz-out once global liquidity dries? Only time will tell!! In the current environment, it looks very unlikely that NIFTY will regain the levels of 200-WMA in a hurry. The risk-reward currently does not look favourable for making fresh investments.

This article is to be originally published in Business India Magazine.

Write to us at news@valuelineadvisors.com

Disclaimer: The views expressed in this article are personal and the author is not responsible in any manner for the use which might be made of the above information. None of the contents make any recommendation to buy, sell or hold any security and should not be construed as offering investment advice.