Indian equities to continue to tango with global markets

The outbreak of COVID-19 has caused a huge disruption in business activities globally. While many countries have decided to keep their economies running, a few, like India, have prioritized citizens’ safety over economic interests by announcing a complete lockdown. Countries are trying to find the right balance between the social and economic impact in managing the COVID-19 crisis.

India announced a complete lockdown of its economy at the end of March 2020, with only essential goods and services allowed to operate. After two months of complete lockdown, the government is now steadily working towards opening up the economy. It recently resumed inter-state public transport services. It is going to be a Herculean task for state governments to relax the lockdown in densely populated but economically important metro cities like Mumbai, Delhi, Kolkata, Chennai, Pune, etc. These cities face an acute shortage of medical infrastructure due to the steady rise in COVID-19 cases. It is equally worrisome to see a steady rise in cases despite the lockdown of the past two months. This lockdown cannot continue forever and will have to, eventually, be lifted. The government will have to be more proactive and decisive in handling this crisis to protect the interests of all stakeholders.

Indian financial markets have been extremely volatile over the past few months. In general, the performance of equities is based on two key factors – the underlying fundamentals of the economy and liquidity flows. Indian equities are presently in uncharted territory, with no clarity on earnings visibility. The fundamentals are clearly deteriorating.

The corporate sector is unable to even provide guidance and is deferring their investments. The MSME segment is also very badly hit with huge stress on their business and cash flows. Even as the government is working towards opening up of the economy, the manufacturing sector in urban areas is facing an acute shortage of skilled workforce as a large number of the migrant workforce have moved back to their home towns and are unlikely to return any time soon. As steps are being taken to resolve supply-side disruptions, the demand environment continues to deteriorate. Companies have been laying-off their employees and cutting salaries to cut costs. People have been cutting down on discretionary spends amid the rising uncertainty over future income.

The RBI has done well by infusing liquidity into the system through LTRO and by cutting interest rates. This has somehow not had the desired impact, as banks have refrained from passing on the benefits to their consumers. The RBI has also announced a moratorium on EMI payments to avoid defaults. If the economic scenario doesn’t improve, banks will eventually see a rise in NPAs in the coming quarters, once the moratorium period is over.

The Central Government has announced a Rs20 lakh crore package, but most of that is in an intangible form – focused mainly on providing immediate liquidity. This is certainly not enough in the current situation as businesses are facing the challenges of survival.

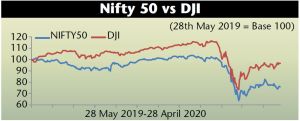

Despite deteriorating fundamentals and an uncertain business environment, NIFTY50 has moved up sharply from its 52-week low of 7511 (23 March 2020) on the back of global factors. Central banks the world over have been very aggressively announcing a stimulus to support their economies. The US Fed has recently announced another $3 trillion stimulus package to contain the damage. This is in addition to the huge stimulus already announced earlier. As interest rates are now close to zero per cent, central banks are now even considering introducing negative interest rates to ramp up spending. These stimulus measures are providing support to global equities. Indian equities too are dancing to the tune of global flows, as has been seen in the past. The bounce-back in Indian equities from the March 2020 lows has come on the back of a strong rally in global equities. FIIs have bought over Rs5700 crore of Indian equities in May 2020 (till 22 May).

Currently, Indian equities are dancing to the tune of global equities and FII’s flows, ignoring the deteriorating macro environment. The actual fundamentals have taken the backseat for the Indian markets. As the dominance of foreign investors continues in the Indian markets, this trend may continue in times to come. In the immediate term, geopolitical factors, such as the growing aggression between US and China as well as the stand-off between India and China, will play a key role in determining market trends.

This article is to be originally published in Business India Magazine.

Write to us at news@valuelineadvisors.com

Disclaimer: The views expressed in this article are personal and the author is not responsible in any manner for the use which might be made of the above information. None of the contents make any recommendation to buy, sell or hold any security and should not be construed as offering investment advice.