Downward spiral in commodity prices could brighten India’s economic prospects

During the past few years, India’s economic growth has been severely affected due to policy inertia, persistently high inflation, a weakening currency and ballooning fiscal and current account deficit. The key reasons for the increase in inflationary pressure in the economy were the higher prices of crude oil and other imported commodities. The expansionary policies adopted by western countries resulted in a significant increase in the price of gold too. With stubbornly high inflation and slow economic growth, investors started allocating more savings towards gold. Gold acted as a hedge against inflation, as other investment avenues provided negative real rates of interest.

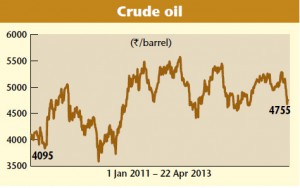

The increase in investment demand for gold has resulted in more money flowing into the commodity, thereby increasing the imports of gold and other precious metals. India has imported $82 billion of gold in the past two years, which is on par with the last 10 years of gold imported by the country. All this has put pressure on India’s current account deficit, which reached 6.7 per cent of GDP in the third quarter of 2012-13, as against 4.4 per cent during the same quarter of the previous fiscal year. During the past few weeks, prices of gold, crude oil and other industrial commodities have fallen substantially. The price of gold has fallen from a high of over $1,900 to about $1,450 per ounce. Similarly, the price of Brent crude oil has fallen from a high of, say, $118 per barrel to some $100 per barrel, while the price of copper has fallen from about $4 to $3.15.

The fall in the price of gold was triggered by the fear of sale of the commodity by the various central banks and the possibility of decreasing monetary stimulus for the ailing economies. The sharp fall in the price of gold has put it in bear territory. While technical indicators point towards a reversal of the bull market, fundamental indicators still suggest caution, as there is hardly any change in the economic fundamentals of western economies.

The other reason for the price of gold falling steeply is the long unwinding by ETFS. The fall in other commodities such as crude oil and copper was driven by lower-than-expected growth in China’s GDP numbers. Experts expect commodity prices to fall further in the near term.

Another factor that could be of real significance in the global context is the decline in the value of the yen. Japan has announced a huge stimulus of $1.4 trillion to boost its deflationary economy. As Japan is one of the largest holders of gold reserves, there is a possibility that Japan could fund this stimulus by selling its gold reserves. This could put further pressure on the price of gold. The yen has weakened sharply from 80-odd levels to 100 per dollar in just six months.

Another factor that could be of real significance in the global context is the decline in the value of the yen. Japan has announced a huge stimulus of $1.4 trillion to boost its deflationary economy. As Japan is one of the largest holders of gold reserves, there is a possibility that Japan could fund this stimulus by selling its gold reserves. This could put further pressure on the price of gold. The yen has weakened sharply from 80-odd levels to 100 per dollar in just six months.

We had commented on the possibility of the yen weakening against the dollar and how that would drive yen carry trade, resulting in more allocation of money towards high risk assets such as equities (Business India dated 3 February 2013). The fall in commodity prices will help improve India’s current account deficit to 4-4.5 per cent of GDP. It will result in lower inflation and help reduce the government’s fuel subsidy bill.

These macro changes are expected to automatically help correct various problems faced by Indian policy makers. Recently, WPI inflation for March 2013 came in at a 40-month low of 5.96 per cent with core inflation falling to 3.4 per cent, which is the lowest since February 2010. The fall in inflation figures significantly increases hopes of interest rate cuts by the RBI in the coming monetary policy review.

As fundamentals of Indian economy are on the mend, we believe Indian equities will get significant allocation arising due to yen carry trade. While the political uncertainty due to upcoming elections still persists, there is an increasing belief among investors that the worst is behind us and good times are in the offing for Indian equities. The equity markets have already started celebrating the expected positives arising due to change in macro fundamentals.

This article was originally published in Business India Magazine.

Write to us at news@valuelineadvisors.com

Disclaimer: The views expressed in this article are personal and the author is not responsible in any manner for the use which might be made of the above information. None of the contents make any recommendation to buy, sell or hold any security and should not be construed as offering investment advice.