Divergence between NIFTY50 and India VIX could derail the rally

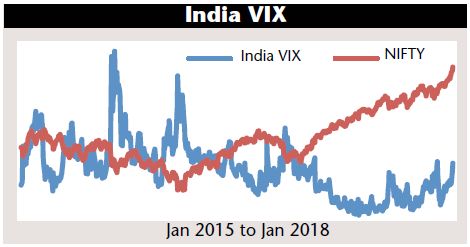

India VIX, India’s volatility index, is disseminated by the NSE. As the name suggests, it measures the degree of volatility based on the buy-sell prices of the NIFTY options contracts. VIX helps gauge market mood and understand the degree of complacency in the market.

Historically, the NIFTY50 and India VIX have had an inverse correlation. The NIFTY tends to show positive momentum when VIX is lower. While the NIFTY has steadily moved up from 8180 levels at the beginning of 2017 to close at 11084 on 23 January 2018, without any meaningful corrections, VIX had averaged 12.70 – ranging between 10.45 and 16.83 during the same period. Markets have continued to rise as VIX remained at lower levels. A low VIX in the current market environment reflects complacency.

As stated in my column: ‘Nifty at 11000’ in Business India (20 November-3 December 2017), the NIFTY reached the psychological mark of 11000 on 23 January 2018, for the first time in history, making Indian markets euphoric. The last 500 point rally in the NIFTY has come in just 17 trading sessions. The index has kept marching ahead, despite extremely overbought conditions and stretched valuations.

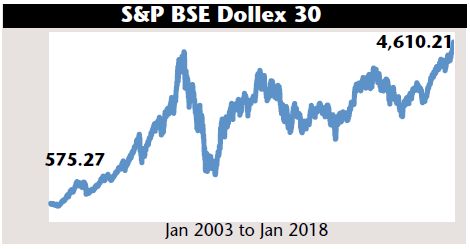

Indian equities are dancing to the tune of an ongoing global rally in risky assets, partly driven by abundant liquidity and improving fundamentals. FIIs have turned buyers in Indian equities as the S&P BSE Dollex 30 recently broke strong resistance, surpassing the previous all-time high of January 2008. The S&P BSE Dollex 30 is the dollar linked version of the Sensex.

The momentum in the NIFTY has been supported by a positive news flow. The corporate results announced so far have been encouraging, showing the Indian economy is in steady recovery mode. The government has recently announced the cutting down of its bond buying programme from Rs50,000 crore to just Rs20,000 crore. The government is set to over-achieve its budgeted divestment target, with the ONGC-HPCL deal adding to its credibility on fiscal prudence for the first time. The IMF has recently raised its forecast for India’s GDP growth to 7.4 per cent from 6.7 per cent earlier.

All eyes are now on the fiscal rebalancing act of the government in the forthcoming budget. This budget assumes special importance, as it will be the government’s first budget after the full-fledged roll-out of India’s biggest indirect tax reform – GST. Investors expect the budget to be growth-oriented, without any hiccups, which could derail India’s fiscal math.

For the last few trading sessions, divergence has clearly been visible between the performance of frontline index stocks and small and mid-cap stocks. While the NIFTY has kept rising, mid-caps and small caps have not participated in the last 500 point rally in the NIFTY50.

There is also a divergence observed between the India VIX and NIFTY. The index has continued to move up, despite a sharp rise in VIX since the last week of 2017. In fact, it has rallied from 10490 on 22 December to close at 11084 on 23 January, even as India VIX has moved up from 11.59 on 22 December to 16.23 during the same period.

The sharp spike in India VIX suggests higher volatility in the near term. The index tends to move up during major events, as uncertainty pertaining to the event results in higher volatility. The market seems to have factored in the major positives, as is reflected in the continuously rising NIFTY during the last few weeks.

Any disappointment or negative development in the near term could result in a sell-off in the markets. It is time to be cautiously optimistic as the risk-reward ratio doesn’t look favorable for fresh investments.

This article was originally published in Business India Magazine.

Write to us at news@valuelineadvisors.com

Disclaimer: The views expressed in this article are personal and the author is not responsible in any manner for the use which might be made of the above information. None of the contents make any recommendation to buy, sell or hold any security and should not be construed as offering investment advice.