200-DMA to act as first defense.

Indian equities have been in a bear grip since the time we last cautioned our readers in ‘Caution ahead’ (Column, 29 January 2018). Since then the NIFTY has fallen by over 1000 points from 11130 (29 January closing). The fall has been even steeper in mid and small cap stocks. The BSE Mid-cap and BSE Small Cap have fallen by 12.5 per cent down by 14.1 per cent respectively from their respective highs, as against a 9.3 per cent slide in the NIFTY. It needs to be noted that the mid-cap and small cap indices had touched their highs 2-3 weeks before the NIFTY made its top.

Even after the precipitous fall in prices, there is still no confidence on the street. Retail investors are sitting on the side expecting markets to correct further. Corrections in bull markets are usually sharp and swift. They spill blood all over the street, but do not last long. On the brighter side, they improve the technical strength for the next up-move. Indian equities are undergoing a similar corrective phase.

The Union Budget announced on 1 February 2018 acted as a trigger point for the start of this corrective move. This correction can be attributed to a mix of domestic and global factors. On the domestic front, introduction of the long-term capital gains tax, slippages on the fiscal deficit front, aggressive budgetary allocation towards social welfare programmes, elevated crude prices, rising inflation etc, have created uncertainty, leading to this corrective phase. The fraud at PNB, and its cascading impact, has further soured sentiment, as investors are concerned about the risk of contagion spreading into the entire banking system.

On the global front, geopolitical issues and risk-off trades in financial markets created panic among FIIs. The aggressive commentary by the Fed on future growth prospects and the possibility of faster-than-expected interest rate hikes in the US added fuel to the fire.

The sharp rise in bond yields over the last few months has increased cost of capital, thereby putting pressure on the already stretched valuations of Indian equities. The NIFTY is now quoting at around 24-25 times historical earnings as per the NSE Website, still at a premium to other emerging markets.

But have the fundamentals deteriorated to an extent that it merits an underweight on Indian equities? The fear of lack of contagion in the Indian banking sector, post the fraud at PNB, is being addressed through stringent regulatory measures. The situation is not as grim as sentiment on the street suggests.

The resolution of the top 12 NPA accounts, which were referred to NCLT under IBC are at an advanced stage of resolution. This will bring over Rs1 lakh crore of fresh liquidity for the banks. There is significant interest in the distressed assets, as is visible from the aggressive bid made by bidders across industries for these assets.

The December 2017 quarter results reflect a turnaround in corporate earnings with more hits than misses. The investment cycle is picking up, as is visible from the rise in demand for commercial vehicles, steel, cement, etc. Inflation too is under control.

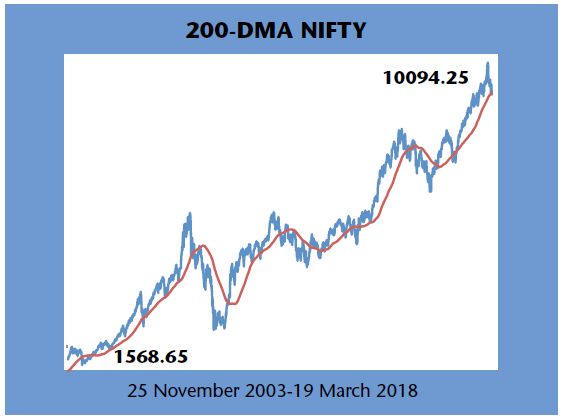

Historically 200-DMA has come to the rescue and acted as strong support for the markets. The NIFTY has not seen any meaningful corrections since end December 2016, when it last crossed 200-DMA, after hitting lows of 7908 on 26 December 2016. Since then, it has moved up by over 3200 points – a massive 40 per cent gain in the span of just 13 months. The recent correction has improved the technical strength of the markets for the next upward move.

The 200-DMA for NIFTY currently stands at about 10160. Similarly, the BSE Midcap and Small-cap Indices too are quoting around their respective 200-DMAs. There is multiple support for the NIFTY around 9900-10000 levels, which will protect more downside. The risk-reward is again turning favourable. After a long wait, markets are providing another buying opportunity for investors.

This article was originally published in Business India Magazine.

Write to us at news@valuelineadvisors.com

Disclaimer: The views expressed in this article are personal and the author is not responsible in any manner for the use which might be made of the above information. None of the contents make any recommendation to buy, sell or hold any security and should not be construed as offering investment advice.