The near-term uncertainty in the IT sector bodes well from a long-term perspective.

In recent times, India’s IT sector has been facing various challenges – a shift towards cloud and automation, digitisation, political factors, such as protectionist approach adopted by the US government, uncertainty in European demand post vote on Brexit, etc.

The US government has already introduced a legislative bill proposing to double the minimum salary of H1B visa holders to $130,000 from $60,000, making it difficult for companies to replace American employees with foreign workers, including from India. This will increase costs for the IT companies, putting pressure on their margins. All this is done at a time when Indian IT companies are facing pressure on the pricing front too. Donald Trump had also warned of imposing 35 per cent tax on firms outsourcing local jobs overseas. The vote on Brexit has further created uncertainty on demand from Europe. These changes in the macro environment have clouded their future growth prospects and have challenged their existing business models.

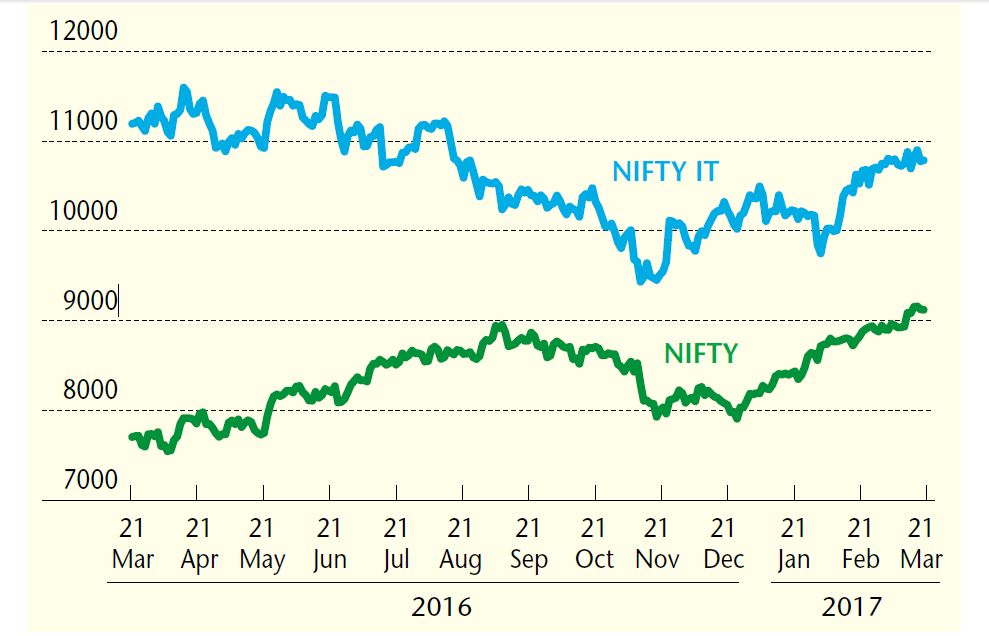

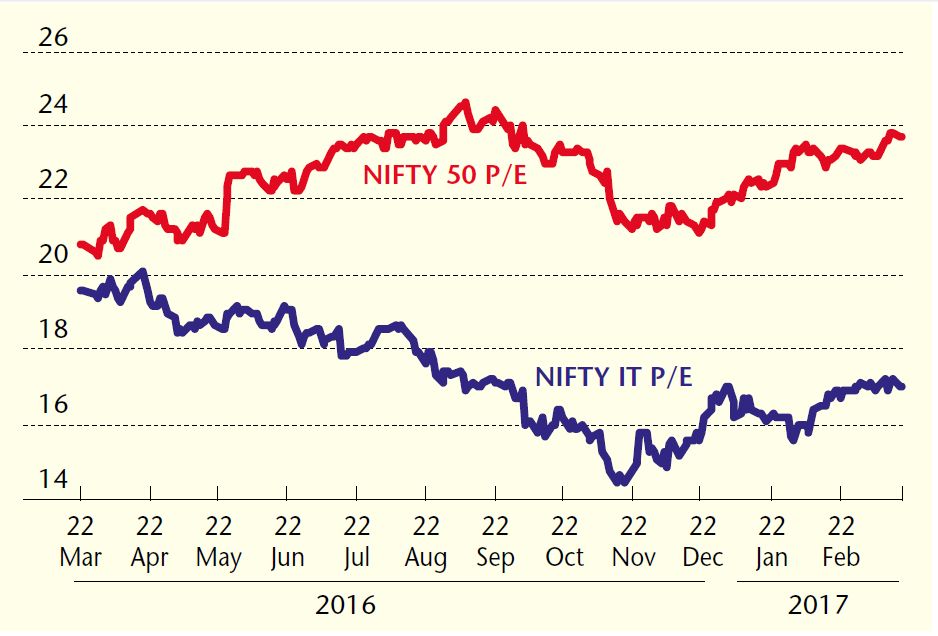

As per various forecasts, the IT industry is undergoing stagnation and is expected to see a sharp drop in growth rates in the coming year. Indian IT stocks have remained under pressure with the NIFTY IT correcting by 4 per cent in the last one year, as against the NIFTY 50, which is up by over 18 per cent. IT majors are now showing some recovery, after trading near multi-year low valuations in December 2016 and January 2017. This is despite the fact that India’s NIFTY 50 is trading near all-time highs.

The Indian IT sector is undergoing disruptive changes. These changes will force IT companies to alter their business models to quickly adapt to the new environment. Fundamentally, IT majors are better placed to face these changes as they have strong balance sheets with free cash-flows and huge cash reserves. With the sharp fall in their stock price, many IT majors have already announced or are in the process of announcing buybacks to reward their shareholders.

The change in the macro environment will eventually create new business opportunities for this sector. Anand Mahindra, chairman, Tech Mahindra, has rightly pointed out that the tightening of the H1B visa regime may open up more opportunities for off-shoring. He feels that the current uncertain environment has the potential to turn out to be India’s Y2K moment. As against the general belief of squeeze on margins for IT companies, he believes there is a potential for expansion in margins. The US does not have plentiful skilled IT professionals as compared to India, as India has been providing these services for the past few decades now. It would be difficult for the US to replace skilled Indian IT professionals in the short term.

Also, as automation increases, there is fear of human jobs getting replaced by machines. Even then new roles will be created where man will have to manage machines. Hiring patterns and skill sets may undergo change, as new roles emerge. Infosys is already considering hiring people educated in liberal arts to add creative skills to its workforce.

After the correction in IT stocks, most of these concerns are already priced in. IT is one of the few sectors today which, despite being fundamentally strong, is quoting at multi-year low valuations. Strong free cash-flows and high dividend payouts provide extra comfort for long-term value investors. This near-term uncertainty for the sector bodes well from a long-term investment perspective.

This article was originally published in Business India Magazine.

Write to us at news@valuelineadvisors.com

Disclaimer: The views expressed in this article are personal and the author is not responsible in any manner for the use which might be made of the above information. None of the contents make any recommendation to buy, sell or hold any security and should not be construed as offering investment advice.