Pick up in investment cycle would drive next phase of economic growth

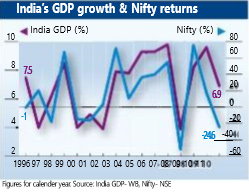

Stock markets are the barometers of any economy. If one analyses India’s GDP growth rate for the past 17 years, the periods of strong GDP growth has led to spectacular rallies in the stock markets. During 2003 and 2004, India’s GDP had grown consistently over 7.8 per cent per annum, after three years of sub-5 per cent growth. Between 2005 and 2007, the economic growth further strengthened with the GDP growing over 9.3 per cent annually. During this phase of strong economic growth (2003-2007), NIFTY had rallied from 1094 levels in December 2002 to 6139 levels in December 2007, providing a CAGR return of over 41 per cent. So, what resulted into such strong economic growth? The key lies in the Gross Fixed Capital Formation (GFCF) in the Indian economy.

GDP is the sum of gross value added by all resident producers in the economy plus any product taxes and minus any subsidies not included in the value of the products. It is calculated without making deductions for depreciation of fabricated assets or for depletion and degradation of natural resources.

What is GFCF? As defined by the World Bank, “Gross fixed capital formation includes land improvements (fences, ditches, drains, and so on); plant, machinery, and equipment purchases; and the construction of roads, railways, and the like, including schools, offices, hospitals, private residential dwellings, and commercial and industrial buildings.”

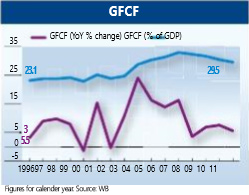

If one looks at the corresponding data for GFCF during the same period (2003-07), GFCF had shown consistently strong growth, indicating fresh capital formation in the economy. During the same period, GFCF as a percentage of GDP had grown from 23.8 per cent in 2002 to over 32.3 per cent in 2008 after hitting the highest levels of 32.9 per cent. Since 2009, this ratio is on a steady decline. In 2011, it fell below 30 per cent levels for the first time since 2005. In each of the past four years starting 2008,

If one looks at the corresponding data for GFCF during the same period (2003-07), GFCF had shown consistently strong growth, indicating fresh capital formation in the economy. During the same period, GFCF as a percentage of GDP had grown from 23.8 per cent in 2002 to over 32.3 per cent in 2008 after hitting the highest levels of 32.9 per cent. Since 2009, this ratio is on a steady decline. In 2011, it fell below 30 per cent levels for the first time since 2005.

If one looks at the corresponding data for GFCF during the same period (2003-07), GFCF had shown consistently strong growth, indicating fresh capital formation in the economy. During the same period, GFCF as a percentage of GDP had grown from 23.8 per cent in 2002 to over 32.3 per cent in 2008 after hitting the highest levels of 32.9 per cent. Since 2009, this ratio is on a steady decline. In 2011, it fell below 30 per cent levels for the first time since 2005.

In each of the past four years starting 2008, the growth in GFCF has been extremely slow and in 2011 it had declined to just 5.5 per cent. Analysis of the recent monthly data in 2012 indicates that gross fixed capital formation has even fallen into a negative territory indicating lack of fresh investments in the economy.

So what has led to a slowdown in the investment cycle? Mainly it is the consistently high inflation, resulting in higher interest rates, slower environmental clearances for infrastructure projects, uncertainty in policy decisions, lack of reforms, increase in fiscal and current account deficit. With lack of government seriousness and credible roadmap to control deficits and inflation, the RBI was hesitant to reduce interest rates, even while the investment climate worsened.

However during the past few months, the government seems to have gathered some courage to push reforms. It has cleared FDI in key sectors of the economy to encourage investments. It has decided to take harsh decisions to control subsidies by way of increasing diesel prices and putting cap on the supply of subsidised LPG cylinders. The government has decided to go ahead with these decisions despite strong opposition.

With strong messages coming from the government on reforms, there is a possibility that the RBI will eventually act in favour of industry by reducing interest rates to support growth. With lower interest rates and strong reforms in the pipeline, the investment cycle could turn positive, much sooner than anticipated. We believe that a pick-up in gross capital formation in the economy would drive the next phase of growth, resulting in another bull phase for Indian equities. And often, the markets, sensing a move in the right direction, move up ahead of the actual pick up.

This article was originally published in Business India Magazine.

Write to us at news@valuelineadvisors.com

Disclaimer: The views expressed in this article are personal and the author is not responsible in any manner for the use which might be made of the above information. None of the contents make any recommendation to buy, sell or hold any security and should not be construed as offering investment advice.