The current fall in the price of midcap stocks provides a great investment opportunity

The definition of a midcap company differs from investor to investor. For the purpose as companies with a market cap between `500 crore and `2,500 crore. As these companies have a relatively smaller base, they have the greater potential to grow faster. Midcap companies are always on the radar of investors looking for high growth, albeit at the cost of some additional risks. Unlike large-cap companies, midcaps have higher beta and come with inherent risks attached to it.

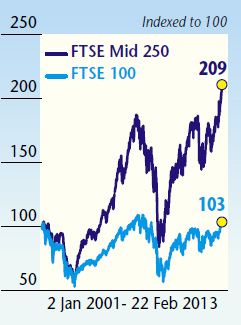

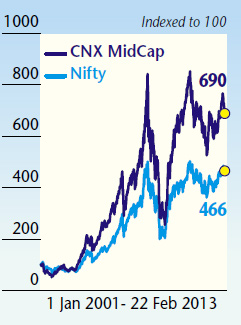

These companies are more affected by the economic slowdown. During the period of the economic slowdown, the prices of midcap stocks fall much more as compared to large-caps. The reverse is also true. If one considers a long-term period of over 10-12 years, midcaps have outperformed large-caps. This trend is true and can be seen for companies across the globe.

A strict analysis of the performance of the FTSE 100 (for large-cap) and FTSE 250 index (for midcap), the UK indices, for a longer period starting January 2001 to now (22 February 2013) shows that the FTSE 250 has outperformed the FTSE 100 by a huge margin. During the period, the FTSE 100 has grown at a meagre CAGR of 0.2 per cent as against 6.3 per cent by the FTSE 250; which has doubled from 6530 levels to 13670 levels, whereas the FTSE 100 has remained almost static from 6175 levels to 6335 levels.

Since September, as the global economy has stabilised and has shown some initial signs of recovery, the FTSE 250 has given returns of 18.8 per cent, as against 10 percent returns by the FTSE 100. It is to be noted that while the FTSE 250 has outperformed the FTSE 100, not all stocks of the FTSE 250 have performed well. The out-performance has mainly come from a select few professionally managed companies which have built their credibility with investors and are rated very high on corporate governance, transparency and an investor friendly approach. Companies in engineering, IT, oil services, defence and resources such as Rotork, Spectris, Spirax Sarco, Renishaw, Melrose Weir, and Babcock have outperformed; whereas companies in transportation, food, utilities and the tobacco sector have underperformed the markets.

In India, while the economic recovery is still to gather momentum, various measures announced by the finance minister and the prime minister’s office (PMO) have created a positive climate, pointing to a revival in the economy in the days to come. Looking at the government’s efforts, the RBI has positively responded by announcing a 25 bps cut in the repo rate in the January 2013 monetary policy, after a long wait of nine months.

Between September 2012 and mid-January 2013, markets have rejoiced over fresh measures announced by the government expecting a revival in the economy. As DIIs kept selling, FIIs bought aggressively into Indian equities. During the same period, the CNX Midcap Index generated returns of around 23 per cent, as compared to 15 per cent from NIFTY. As markets neared previous highs and investors booked some profits, markets gave up part of the recovery. In the recent period (15 January-22 February 2013), while the falling NIFTY seems to be just 3.4 per cent, midcap stocks have seen major correction. The CNX Mid Cap Index fell 8.8 per cent during the same period, thereby resulting in a healthy overdue correction, setting up base for the next move-up.

With the Union Budget and government looking determined to get the economy back on track, the current correction provides an opportunity for investors to invest in fundamentally sound Indian midcap companies. Whenever economy recovery gains pace, the growth of Indian midcaps will be much higher than the midcaps in the West. Investors need to be selective in their investment approach and invest only in those fundamentally strong midcap companies which have, over a longer period, proved their mettle.

This article was originally published in Business India Magazine.

Write to us at news@valuelineadvisors.com

Disclaimer: The views expressed in this article are personal and the author is not responsible in any manner for the use which might be made of the above information. None of the contents make any recommendation to buy, sell or hold any security and should not be construed as offering investment advice.