When the going gets tough, the tough get going.

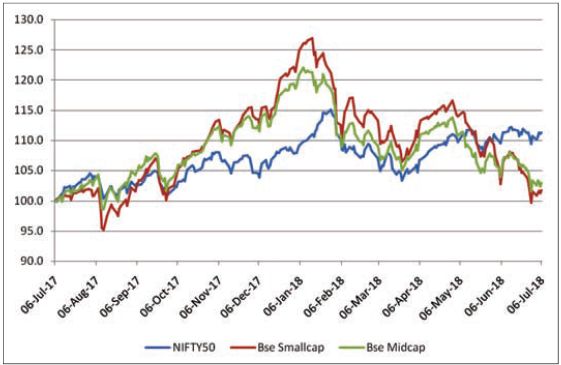

India’s frontline index, NIFTY 50 has been trading in the narrow range between 10400-10850 points since the last three months, but a closer look at the broader market reveals a very dismal picture. While NIFTY 50 is holding on steady, small and mid-cap indices are trading at the levels last seen when NIFTY was around 9700. A large number of mid-cap and small-cap stocks have fallen sharply and are quoting way below their 52-week highs. Many of these stocks are trading near the prices seen during the beginning of the bull-phase of 2014-15.

The midcap and small cap indices which had seen sharp outperformance vis-à-vis NIFTY 50 in the calendar year 2017, have given up all their gains in the current corrective phase. Since the announcement of the Union Budget on 1 February 2018, NIFTY has fallen by just 2.2 per cent, whereas BSE midcap and small-cap indices have fallen by 10.9 per cent and 14.2 per cent respectively.

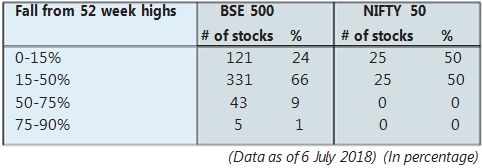

The table below shows one in every ten stocks from the BSE 500 index has fallen by over 50 per cent from their 52-week highs. Similarly, two out of three companies from bse 500 has fallen between 15-50 per cent. This shows the extent of price erosion in mid and small cap stocks in the past few months.

The reason for this correction can be attributed to a combination of several factors – be it risk of economic disruptions due to trade-wars between the US and China, surging crude prices resulting in a higher trade deficit for India, the falling Indian rupee and rising USD, rising yields due to higher risks of inflation, rise in unplanned spending prior to elections, and most importantly fear of change of government at the Centre post the 2019 elections. The USD has strengthened by 6-7 per cent this year. Emerging market equities are having a tough year. Large EMs such as Brazil, China, Turkey have fallen sharply year-to-date. These factors have soured market sentiments.

Majority of the negative news flow seems already factored – in post recent correction. Valuations which were looking stretched have again started looking attractive in the midcap space. There was huge divergence between mid-cap, small-cap and large-cap indices. In last one month between 31 May and 6 July 2018, NIFTY 50 has remained flat, whereas BSE midcap and BSE small-cap indices have fallen by 3.9 per cent and 6.9 per cent respectively. This situation cannot continue for long. Either the broader market will resume the uptrend or front-line NIFTY stocks will collapse. Considering the state of the economy, the probability of resumption of uptrend for broader market looks more likely.

Corporate earnings are only going to improve going forward, which will support the market. Crude oil prices, which are controlled by a cartel, are unlikely to move substantially higher from here as there is pressure from the US on OPEC to increase output. The trade tensions too will keep crude prices under check. In the medium term, crude prices are more likely to fall than rise. This will automatically correct the problem of the trade deficit and weakening currency for India. Good monsoon and the government’s increased impetus on agriculture and rural economy should act as booster for the Indian economy. Despite expectation of a sharp rise in retail inflation, the CPI inflation came in at 5 per cent as against the consensus expectation of 5.2 per cent. NIFTY has already reclaimed the psychological mark of 11000.

The negative hype created by the media regarding the risk of change in the government at the Centre is more imaginary than real as the Lok Sabha elections are still nine months away. The concern seems to be overdone. It is an opportune time for investors to start increasing allocation towards quality midcap and small cap stocks for long-term holding. It is rightly said – “When the going gets tough, the tough get going,” and that’s the secret of generating alpha returns in the markets.

This article was originally published in Business India Magazine.

Write to us at news@valuelineadvisors.com

Disclaimer: The views expressed in this article are personal and the author is not responsible in any manner for the use which might be made of the above information. None of the contents make any recommendation to buy, sell or hold any security and should not be construed as offering investment advice.