Post rally in front line stocks, mid-caps to follow suit.

Indian equities are in a state where there are more doubts, despite clear signs of an economic recovery. The persistent efforts of the government to revive the economy have started yielding results. For the past many quarters the improvement in macro indicators was not getting translated into earnings growth. However, in the March 2016 quarter, corporate results seem to have turned a corner. The topline, as well as bottom line, growth of corporates (excluding banks and metals) have exceeded street estimates with more hits than misses. The pace of downgrades has reduced. Operating margins (excluding commodities and banks) have shown significant expansion.

The GDP growth rate of 7.9 per cent in 4QFY16 was a big surprise for most analysts. This momentum is expected to continue as the effect of the VIIth Pay Commission, OROP, and pick up in rural demand post monsoon kicks in. The government has already initiated investment in infrastructure projects such as roads and railways, giving impetus to the economy. The momentum is clearly visible from the pick-up in cement dispatch volumes and robust results posted by infrastructure giant, L&T. Economic recovery will improve cash flows and help corporates reduce leverage. This will reduce stress in the banking sector through lower NPAs. The state election results show an encouraging trend for the ruling government as it will strengthen its position in the Rajya Sabha and help pass key legislations.

Positive factors such as improvement in corporate earnings and domestic economic revival are masked by global uncertainties such as a possibility of interest rate hike by the Fed, BREXIT, deteriorating financial health of countries dependent on commodities, policy uncertainty by Japanese central banks, etc. These factors, along with domestic uncertainties over risk of delayed monsoons, rising NPAs in the banking sector, dismal earnings growth, highly-levered balance sheets, premium valuations vis-à-vis other emerging markets, have kept investors worrying.

These concerns seem to be overdone. With lots of discussions regarding the Fed rate hike, markets seem to have factored in this event. The quantum of the hike and the commentary regarding future rate hikes is the key uncertainty. Crude has bounced from the dismal mid-30s to over $50 per barrel, which will bring financial stability for oil and gas exporting countries.The arrival of monsoons may have got delayed by a few days, but both India’s leading meteorological agencies have indicated above-average monsoons this year.

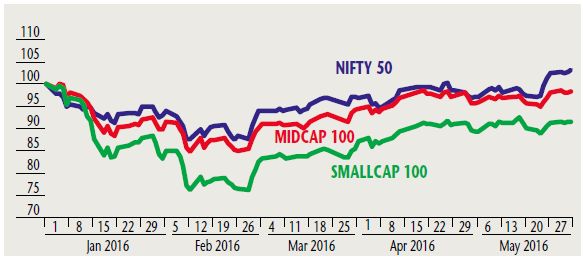

While a lot of these uncertainties are yet to unfold, investors clearly seem to have put these concerns on the backburner. The NIFTY50 shot up by 6.3 per cent from 7730 to 8230 in the last week of May – a sharp 500 point move. This rally was driven mainly by large-cap front line stocks, without any meaningful participation from mid-caps and small caps. As compared to 6.3 per cent returns in NIFTY50, NIFTY Midcap 100 and NIFTY Smallcap 100 are up by just 3.1 per cent and 2.2 per cent respectively between 23 May and 2 June.

Since beginning of CY16, the NIFTY50 is up by 3.2 per cent as against 1.5 per cent fall in NIFTY Mid-cap 100 and 8.4 per cent fall in NIFTY Smallcap 100. There is a lot of catch-up to be done by midcap and small cap stocks. As confidence has started building with the NIFTY stabilising at higher levels, mid-caps and small caps will eventually start catching up. There is ample liquidity to invest into Indian equities. FIIs continue to remain upbeat on the India growth story. The domestic retail segment too has started investing into equities through Systematic Investment Plans (SIPs). As per data from AMFI, total SIP accounts crossed the one crore mark in April 2016. This can potentially bring into Indian equities a regular monthly inflow of over Rs3,000-3,500 crore through the domestic mutual fund route, which will find its way into good quality midcaps.

There is a lot of noise about pricey valuations of the Indian markets, but it needs to be noted that these valuations are based on highly depressed earnings. As earnings start picking up, these valuations will start looking attractive. It is time to bet big on the midcap and small cap stocks as they will eventually catch up with the front line stocks.

This article was originally published in Business India Magazine.

Write to us at news@valuelineadvisors.com

Disclaimer: The views expressed in this article are personal and the author is not responsible in any manner for the use which might be made of the above information. None of the contents make any recommendation to buy, sell or hold any security and should not be construed as offering investment advice.