Long awaited US rate hike a non-event for Indian markets

After the sub-prime crisis of 2008, the interest rates in the US were kept near zero per cent for an extended period of time, to support its ailing economy. For the past few months as data points from the US showed signs of improvement, Federal Reserve had earlier hinted at eventually ending zero-rate policy by rising interest rates.

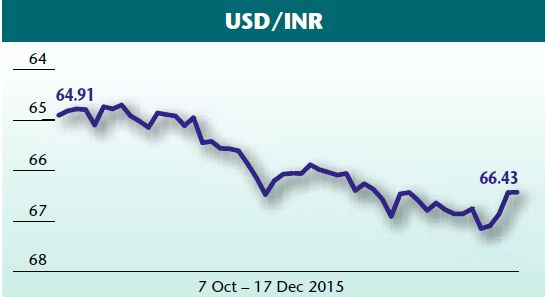

There was too much hype created globally with respect to the impending rate hike, as it had the potential to affect liquidity in the already fragile global economy. In anticipation of the rise in interest rates in the US, the dollar kept strengthening against all major currencies. Indian currency too felt the brunt of this trend, with the rupee depreciating from Rs64.78 on 9 October 2015 to Rs67.10 on 14 December 2015 – just before the two-day Fed meet, which was scheduled for 15-16 December 2015.

Finally, the much-awaited high-profile event ended with a full-consensus 25 bps interest rate hike for the first time in nine years, thereby ending the zero-rate policy of the Fed. The financial markets were fully prepared for this event and had already factored in this rate hike. Thus, one of the most dramatised events of year 2015 eventually turned out to be a non-event for Indian markets.

We have been constantly reiterating our view in Business India issues between 6 July and 23 November 2015 about how India was relatively immune and better placed to weather a US interest rate hike, as compared to other emerging markets. The Reserve Bank of India was fully prepared to face any eventuality in case of turbulence in the run-up to this event. Despite the interest rate hike by the Fed, the rupee bounced back after hitting lows of Rs67.13/dollar and was quoting at Rs66.43. Market participants claim that RBI had intervened in the bonds and currency markets to smoothen the effect of volatility. Despite the rise in the US interest rates, 10 year government of India bond yields fell from 7.78 per cent to 7.71 per cent on 17 December.

Indian equities, trading in a lackluster manner over the past few weeks, rallied sharply, in line with other global markets, ending the day higher by 1.21 per cent. NIFTY 50 closed 93 points higher at 7844.

India is now in the sweet spot among most emerging markets as it has substantially mended its fiscal position by taking full benefit of the fall in international commodity prices. India’s IIP for October grew at a five-year high of 9.8 per cent. The Wholesale Price Inflation (WPI) for November 2015 came in at minus 1.99 per cent, remaining in negative territory for 13 months in a row. The Consumer Price Inflation (CPI), on the other hand, rose to a 14-month high of 5.41 per cent, primarily due to y-o-y base effect and impact of rising prices due to poor monsoons.

While nominal interest rates in India are falling, the real interest rates are on the rise. Despite recent rise in CPI inflation in November, there is still comfortable differential of over 230 bps between 10-year government of India bonds (7.71 per cent) and CPI inflation (5.41 per cent). RBI had earlier maintained real interest rates at around 1.5-2 per cent. So, there is still a margin of safety of up to 100 bps increase in interest rates by Fed.

Even the differential between 10 year government of India bond yields (7.71 per cent) and 10 year US government bond yields (2.24 per cent) stood at 5.5 per cent, reflecting the differentials in the inflationary rates in the two countries. However, India’s actual CPI inflation stood at 5.41 per cent versus the US’s inflation of 0.5 per cent for November 2015, indicating a differential of 4.9 per cent. This gives Reserve Bank of India some space to cut interest rates, despite the rise in US interest rates. India is comfortably placed in terms of Forex reserves which stood at $352 billion, despite the recent sell-off by FIIs in the debt and equity markets. All major factors are pointing towards the strengthening of the Indian economy. As the uncertainty from this major global event is behind us, investments into Indian markets are all set to rise in the time to come.

This article was originally published in Business India Magazine.

Write to us at news@valuelineadvisors.com

Disclaimer: The views expressed in this article are personal and the author is not responsible in any manner for the use which might be made of the above information. None of the contents make any recommendation to buy, sell or hold any security and should not be construed as offering investment advice.