India is better placed to weather US interest rate hike.

Until last year, there was serious doubt about whether US Fed will hike interest rates anytime soon, given its fragile economic recovery. Over the last one year, the probability has increased considerably, with gradual improvement in the economic recovery. The timing of rate hike could be argued, but the event now looks inevitable. The consensus indicates at least one rate hike before end of 2015. The US FED has kept interest rates at near zero per cent since 2008.

Whenever US hike interest rates, there is a possibility of knee jerk reaction in the financial markets of emerging economies. Emerging markets, especially the ones with weak fundamentals, could witness a strong outflow of FII funds back into the US, causing turbulence in their financial markets. Emerging economies could witness pressure on their currencies, with the dollar strengthening.

Fortunately, India has been able to mend its finances over last one year, primarily due to fall in international crude prices and tight budgetary monitoring. The new government has been successful in keeping inflation and twin deficits under control and has laid clear road map for fiscal consolidation. Inflation is on steady decline and Indian bond yields are seeing downward trend. The Government has initiated various reforms to revive growth which has kept foreign investors’ interest high in India.

India is comfortably placed even on foreign exchange reserves. India’s foreign exchange reserve has shot up from $292 billion in January 2014 to $355 billion in June 2015, after the new government took control of the economy.

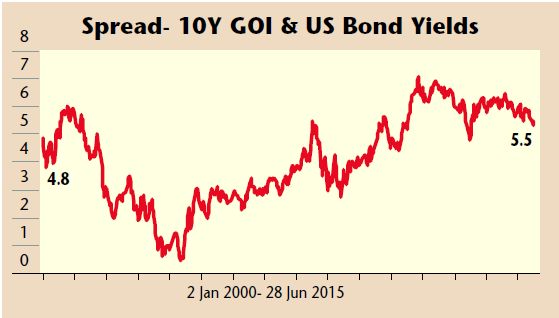

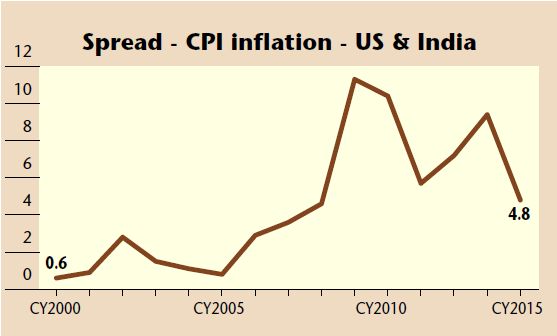

India’s 10-year government bond yields about 7.86 per cent currently, as against the 10-year US bond yields of 2.36 per cent, providing a differential of about 5.50 per cent. Theoretically, the spread in the bond yields of the two countries reflect the differentials in the inflationary rates in the two countries. India’s CPI inflation has averaged about 6.9 per cent per annum between 2000-14, as against US’s average of 2.4 per cent. This provides a long-term average differential of about 4.5 per cent. Because of the downward bias in India’s inflationary trend and the ongoing recovery in the US economy, this differential may narrow further, supporting the case for a fall in bond yields in India, despite the rise in US interest rates.

In its June 2015 monetary policy, the RBI had raised concerns over the risk of rising inflationary pressure in the economy due to ‘below normal’ monsoon forecasted by IMD. This resulted in rise in bond yields, despite 25 bps cut in REPO rates by the RBI. So far, the monsoon has remained on track and has covered entire country by 26 June – 20 days ahead of normal date of 15 July. Also, the country has received 16 per cent more rainfall than what was normal in June. This reduces the immediate risk of rise in inflationary trend in the economy, further supporting the case for lowering of interest rates in India.

Now let’s see the implications of rise in US interest rates during 2004-2007 periods. The US Interest rates started rising from early-2004 to mid-2007. The effective federal funds rate in the US rose from 1% in Jan 2004 to 5.24% in July 2007. The federal funds rate is the interest rate at which depository institutions trade federal funds (balances held at Federal Reserve Banks) with each other overnight. The effective federal funds rate is essentially determined by the market but is influenced by the Federal Reserve through open market operations to reach the federal funds rate target.

During this period, given the strong revival in the Indian economy, the FIIs had invested aggressively into the Indian markets, despite a rise in US interest rates. Indian equity markets had rallied sharply, despite the rise in US interest rates.

The hike in US interest rates could certainly tighten the global liquidity and adversely affect the emerging economies in the immediate term, but given the strong fundamentals of India, the impact is likely to be limited in the medium to long term. India has got enough space to lower interest rates, despite the rise in US interest rates. Indian markets are set to move ahead, as the clouds of global uncertainty disperse.

This article was originally published in Business India Magazine.

Write to us at news@valuelineadvisors.com

Disclaimer: The views expressed in this article are personal and the author is not responsible in any manner for the use which might be made of the above information. None of the contents make any recommendation to buy, sell or hold any security and should not be construed as offering investment advice.