NIFTY unlikely to break 200-DMA.

There are noises from all sections of the analyst community that recovery of the economy is taking much longer than anticipated. There is pressure on the government to perform, as its efforts are not getting converted into results.

After the new government was elected last year, there was a lot of expectation to quickly revive the economy by framing the right policies, strategising, planning and better monitoring.

While a lot of changes have started happening, the pace at which these reforms are implemented is much slower than anticipated. There are concerns over earnings growth. Most analysts are now expecting earnings growth to be muted in the ongoing earning season. There are talks of a possibility of downgrades post this earnings season. Investors who were gung-ho about a quick revival of the Indian economy now have more realistic expectations.

NIFTY has corrected sharply by over 8 per cent from all-time highs of 9119 on 4th March 2015 to 8377 on 21st April 2015, in just about 30 trading sessions. The mood has changed from being overly optimistic to cautiously optimistic. The recent correction has removed froth from the markets.

The fall in NIFTY is being attributed to various factors such as debt worries in Greece, uncertainty over applicability of MAT for previous years for foreign investors, the possibility of an earlier-than-expected rate hike in the US on the back of the Chinese downturn, ongoing war in Yemen, risk of earnings downgrades, etc.

While these factors have soured sentiment, the primary reason for this correction seems to be a sharp rise in markets resulting in stretched valuations. The market has run up too fast in the last one year. The NIFTY is richly valued and is trading at a premium to other emerging markets, despite lower-than-expected earnings growth.

But, should investors worry too much about this ongoing correction? Various economic indicators are pointing towards revival. Since the beginning of CY15, the RBI has cut interest rates twice, by 50 bps to 7.5 per cent. Commercial banks, which were hesitant to pass on the rate cuts, have started cutting lending rates. Lower interest costs will improve profitability of the corporates. WPI inflation, which remained a major cause of concern during the last few years, has been decelerating. It has fallen for the fifth straight month, plunging into a negative zone, thanks to the sharp fall in global crude prices. The IIP number is positive and is steadily inching up – indicating improvement in manufacturing activity. Commercial vehicle sales are on a rise. Foreign exchange reserves are near all-time highs of $340 billion, providing a cushion to the Indian currency. The Indian rupee is one

of the best performing currencies globally and has shown resilience to strengthening of the US dollar against other currencies. Corporate earnings growth is expected to pick up pace over next couple of quarters.

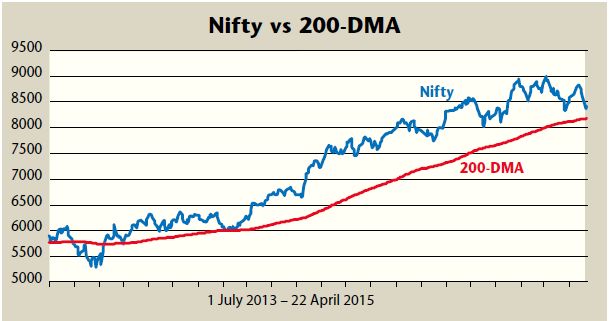

NIFTY is retracing from the higher levels and is undergoing consolidation. This consolidation phase will make markets technically stronger for next up move. NIFTY is currently trading comfortably above 200 day moving average (200-DMA) which is around 8180 level. 200-DMA is widely tracked technical indicator and is considered as major support for the markets.

The chart shows that the NIFTY crossed 200-DMA in early September 2013 and since then has remained above that level, taking support at 200-DMA. The gap between the NIFTY and 200-DMA has kept widening post the BJP’s thumping victory last year. It is only now, after almost a year, that the NIFTY is again inching towards 200-DMA.

Looking at the signs of improvement in the economy and expected revival in earnings over the next few quarters, the NIFTY is not likely to fall below 200-DMA. This correction provides an excellent opportunity for investors to increase exposure to equities, to make the most of the next up move. Indian equities are in the structural Bull Run and once the clouds of uncertainty disperse, the NIFTY will most likely touch the five digit mark for the first time in its history in the months to come.

This article was originally published in Business India Magazine.

Write to us at news@valuelineadvisors.com

Disclaimer: The views expressed in this article are personal and the author is not responsible in any manner for the use which might be made of the above information. None of the contents make any recommendation to buy, sell or hold any security and should not be construed as offering investment advice.