A series of major events in the next two months may trigger intermediate correction in the market

The Volatility Index (VIX) is a measure of the market’s expectation of volatility over the near term. Volatility is often described as the “rate and magnitude of changes in prices” and in finance often referred to as risk. VIX is a measure of the amount by which an underlying index is expected to fluctuate, in the near term, calculated as annualised volatility, denoted in percentage terms based on the order book of the underlying index options.

India’s VIX is a volatility index based on NIFTY Index Option prices. From the best bid-ask price of NIFTY Options contracts, a volatility figure is calculated, which indicates the expected market volatility over the next 30 days. The India VIX is a measure of the investor’s expectation of volatility in the NIFTY.

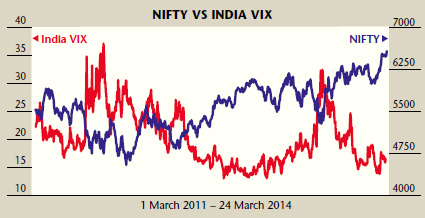

To understand how the NIFTY and VIX are correlated, let us analyse the trend of the India VIX and the corresponding levels for NIFTY for the past three years starting March 2011 (see graph). The analysis shows a very high inverse correlation of -0.81 between the NIFTY and VIX.

Since the India VIX was launched, the index has hit an alltime high of 56.07 on 19 May 2009 and alltime low of 13.04 on 22 October 2012 on closing basis.

The constantly rising markets with low VIX suggest complacency in the investors’ behaviour as option prices are lower even while markets are moving higher. Historically it is seen that in constantly rising markets with VIX below 16-17 levels, there is a higher probability of the NIFTY facing risk of intermediate correction.

In the last month Indian markets have run up sharply, but in terms of economy recovery India is still not out of the woods. Economic growth is still anaemic. IIP numbers indicate a weakness in industrial production. The investment cycle is yet to show any significant signs of improvement; though there are early signs of bottoming out of the economy.

Markets have moved up strongly, factoring in the possibility of a strong NDA government led by Narendra Modi as prime minister in the coming elections, which would provide a stimulus to economic recovery. Any disappointment or change in expectations in the run up to the elections would create high levels of volatility and panic in the markets.

Various key events are lined up in the next few months. Uncertainty over the Russia-Crimea-Ukraine crisis,

worsening Chinese economic data, the RBI’s monetary policy, upcoming results season and huge uncertainty over impending general elections could create high volatility in the equity markets over the next few months.

As of 24 March, even in the constantly rising markets, the India VIX is quoting at 16.54 levels which indicate that investors are getting complacent even as markets are moving higher and touching all-time highs. Indian markets have outperformed most emerging markets. The markets have run up too fast and any disappointment could create volatile moves and panic selling in the markets. Market participants should be prepared for higher volatility and intermediate correction in the run up to the elections in the next couple of months.

However, long-term investors have little to worry about. Despite the uncertainties, FIIs have kept pouring money into Indian equities. The rupee has shown tremendous strength despite the possibility of a rise in US interest rates in the next few months. The NIFTY is trading comfortably above 200-DMA. In March 2014, the NIFTY decisively broke major resistance by breaching previous all-time highs. Most investors are sitting on the sidelines waiting for the correction to buy into Indian equities. All these factors suggest that India has stepped into a fresh bull-run. This intermediate correction may provide an excellent opportunity for investors to buy quality stocks at reasonable valuations.

This article was originally published in Business India Magazine.

Write to us at news@valuelineadvisors.com

Disclaimer: The views expressed in this article are personal and the author is not responsible in any manner for the use which might be made of the above information. None of the contents make any recommendation to buy, sell or hold any security and should not be construed as offering investment advice.