Direction of the interest rate movement will drive banking stocks

Interest rates after a long period of a northbound journey are finally set to drive down, over the next few months. During the first half of 2012 when the industry was struggling due to high interest rates, policy inertia and the worsening fiscal situation, the Reserve Bank of India (RBI) indicated through its monetary policy that the interest rate cycle has peaked. However, while the central bank still maintains a hawkish stance on the inflationary pressures in the economy, the interest rates have failed to come down, despite further slowing down of the economy.

While inflation has recently showed some early signs of easing after the 13 consecutive rate hikes in the short span of 19 months, it has still remained above the RBI’s comfort zone. Considering the RBI’s adamant stance towards inflation and looking at the deteriorating fiscal situation, the government announced various measures to correct the deficit problem and also started working towards fiscal consolidation. It also announced various reforms targeting foreign investments into the country.

With the government getting back into action mode and taking corrective steps towards fiscal consolidation and also considering tremendous pressure from various industry bodies including the finance ministry, the consensus is that the RBI may cut interest rates in the coming months. Clearly, the drop in interest rates is positive for the banking industry in multiple ways and has a trickle down effect as a whole. Firstly, the fall in interest rates pushes up the bond prices resulting in gains on their treasury portfolio. Bonds form significant component of banks’ portfolio.

Secondly, a slash in the rates reduces the cost of funds for the banks leaving positive impact on the net interest margins (NIMs). Thirdly, reduction in rates, witnesses a revival in demand in the economy steering banks to grow their loan books. Finally, as the economy improves, asset quality improves in the form of reduced NPAs.

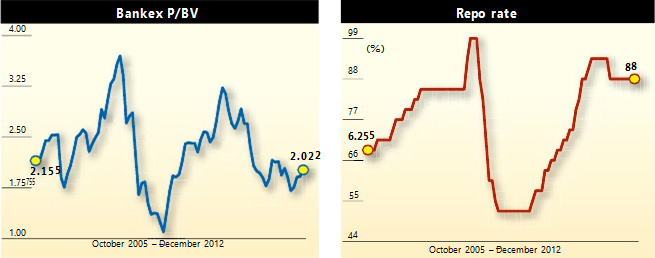

Now let’s take a look at the historical valuations of the BSE Bankex during different phases of the interest rate cycle. The BSE Bankex is the basket of 14 most frequently traded bank stocks on the Bombay Stock Exchange (BSE). The historical analysis of BSE Bankex shows that valuation tends to bottom out when interest rate cycle peaks, though with a lag of few months. For instance, in July-September 2008 when the interest rate cycle peaked, the RBI repo rate was at 9 per cent. The BSE Bankex bottomed out in March 2009 when it was trading at valuation of 1.1 times price/book value (P/BV). In February 2010, when the interest cycle bottomed, reporates were at 4.75 per cent. Again, after a lag of six to eight months, in November 2010, BSE Bankex was trading at valuations of 3.2 times P/BV, providing substantial returns to the investors.

Recently interest rates have peaked in March 2012 and BSE Bankex valuations seem to have bottomed at 1.7 times P/BV in August 2012. While the banking sector still faces headwinds in the near term, this period of peaking interest rates provides an excellent opportunity for the long term investors to invest in banking stocks.

Catch them right and watch them grow.

This article was originally published in Business India Magazine.

Write to us at news@valuelineadvisors.com

Disclaimer: The views expressed in this article are personal and the author is not responsible in any manner for the use which might be made of the above information. None of the contents make any recommendation to buy, sell or hold any security and should not be construed as offering investment advice.