Despite high crude prices, Nifty to continue its northward journey

It is a widely known fact that the economic growth in emerging markets like India is highly dependent on crude oil prices. For a country like India, where more than 75 per cent of its oil requirement is met through imports, the movement of crude prices has huge relevance. The rise in crude prices has a direct impact on macro economic indicators.

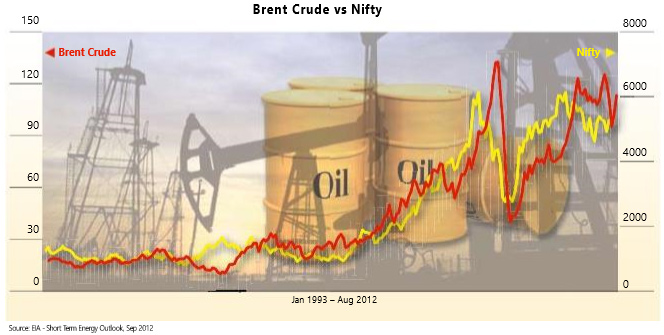

Theoretically, higher crude prices result in high inflation, increase in fiscal deficit, higher interest rates, lower investments, etc. These factors have a negative impact on economic growth and thereby affect stock market performance. Due to this, there is strong perception that higher crude oil prices have negative correlation with the Indian stock market. But the reality is different.

To understand the correlation, take the monthly data for Brent crude prices and Nifty for the past two decades starting January 1993 (see chart). India mainly uses Brent crude as a benchmark and hence we have taken Brent crude prices to better understand the correlation on the Indian stock markets. As against the perceived belief of negative correlation, the data suggests very high positive correlation between the two. As against the common belief that crude prices are driven just by the fundamental factors of demand and supply, in reality, just like any other asset class, crude prices are also prone to the various speculative forces in the short term. Despite a slowdown in global demand, a significant increase in global liquidity by way of various rounds of Quantitative Easing (QEs) by the central banks in the US and Europe and also the rising geopolitical tension in Iran has resulted in an increase in the price of various commodities including crude oil.

While a global economy recovery still looks weak, we believe that crude prices are likely to remain high. Given the very high correlation between the Nifty and crude prices, the cur- rent trend of higher crude oil prices is unlikely to dampen the strong momentum in the Nifty as was seen during 2008 when it had reached a high of over 6200 even while crude was trading near its all time high.

As mentioned in my earlier article Time to Breakout (Business India dated 19 August 2012), the Nifty took support around 200 DMA (daily moving average) and bounced back sharply to 5700 levels. With the indication of strong policy reforms by the Government; the Nifty’s north- ward journey is likely to continue.

This article was originally published in Business India Magazine.

Write to us at news@valuelineadvisors.com

Disclaimer: The views expressed in this article are personal and the author is not responsible in any manner for the use which might be made of the above information. None of the contents make any recommendation to buy, sell or hold any security and should not be construed as offering investment advice.