PSU banking stocks may consolidate during the next few months

This is in continuation to the guest column titled ‘Bank on public sector banks’, which was published in this magazine, dated 23 December 2013-05 January 2014. The previous article discussed the strong investment opportunities available in public sector banks. These public sector banks were quoting at multi-year lows, distress valuations and had underperformed the broader markets by huge margins, primarily due to poor fundamentals. The risk reward ratio was favourable for investments in public sector banks.

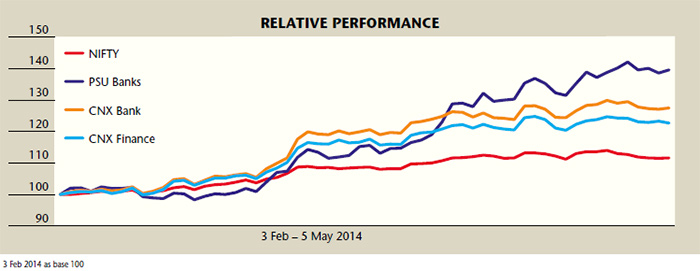

During the three-month period of 3 February-5 May 2014, the PSU Bank Index has shot up by 39.6 per cent, as against 11.6 per cent rise in NIFTY, 22.7 per cent rise in CNX Finance and 27.5 per cent rise in CNX Bank NIFTY. Despite weak fundamentals, the CNX PSU Bank Index has out-performed all the three indices by big margins.

Though PSU banks have run up too fast in the last three months, there is little change in their fundamentals. Most of the PSU banks are still struggling with the problem of high non-performing assets (NPAs), elevated impaired asset formation, low capital adequacy ratio and low provision-coverage ratio. These factors have adversely affected their profitability. The RBI has taken the necessary steps to keep these banks afloat and help them survive the crisis. It has allowed PSU banks to sell their NPAs to Asset Reconstruction Companies (ARCs) such as ARCIL to keep a tab on rising bad loans. The RBI has also allowed these banks to amortise the losses from the sale of bad loans over next two years.

The Q4 results of select PSU banks show initial signs of bottoming out. In a few cases, asset quality has improved, though this could be attributed to the sale of bad loans to ARCs and improvement in recoveries. Strong operational performance in the form of higher growth in net interest incomes (NIIs) could not translate into improved earnings as provisions have continued to increase. The Tier I capital adequacy ratio remains extremely low in most cases and strong growth in loan book would burn capital at equally faster rates, thereby increasing the need to raise fresh capital.

PSU banks stand the risk of huge equity dilution in the years to come to comply with Basel III norms, as their capital adequacy ratios are extremely low. The RBI’s recently announced relaxation of Basel III norms for public sector banks by one year also indicates that the central bank is not confident of recovery in PSU banks’ performance in the near term. The steps taken by the RBI confirm an ongoing crisis in the public sector banking space.

After the recent run up, the PSU Bank Index has now corrected its distress valuations and is quoting at 1.07 times ‘price to book’. Investors have lapped up the shares of PSU banks, anticipating pick up in the economy, driven by reforms by the new government. The valuations of these banks are still much below their long-term averages, but it rightly reflects the challenges faced by the industry. The PSU Bank Index is now fairly valued and could see the price consolidating in the 5-7 per cent trading range.

This article was originally published in Business India Magazine.

Write to us at news@valuelineadvisors.com

Disclaimer: The views expressed in this article are personal and the author is not responsible in any manner for the use which might be made of the above information. None of the contents make any recommendation to buy, sell or hold any security and should not be construed as offering investment advice.