Markets are expected to consolidate at current levels

From the level at end August 2013, when the CNX NIFTY touched intermediate lows of 5285, markets have bounced back sharply, rising almost 20 per cent in September October to regain highs of 6342 by Diwali. This was primarily driven by the postponement of QE tapering by the FED and the various measures taken by the RBI governor to support the currency.

The sharp rally has surprised most market participants. The market has again proved that it moves independent of what most market participants expect. All the pessimism surrounding the markets due to current account deficit (CAD), currency weakening, FED tapering, political uncertainty, rising inflation, and strengthening of bond yields are put to rest. Foreign institutional investors (FIIs) have dominated Indian equities by their aggressive buying in the Indian front line index stocks, despite continuous selling by domestic investors. DIIs have used this opportunity to sell equities during this strong up move, partly to meet redemption pressure from the retail investors.

Even as frontline indicesare trading near new highs, midcap and small-cap indices are still largely unaffected in this rally and are trading at significant discount to their January 2008 and November 2010 highs. While there are some initial signs of bottoming out of economy, there is no firm indication of economic revival as is visible from the weak IIP data, rising inflation numbers, and continued weakness in fresh investments and gross capital formation. The only silver lining in this slowing economy is that most of the large cap companies have reported performance, which is above analysts’ expectations, showing that they are better poised to tackle this economic slowdown than smaller companies.

Janet Yellen, the nominee for the post of chairman, Federal Reserve, has recently underscored her commitment to strengthen the economy before cutting monetary stimulus suggesting that FED may not start tapering before mid of next year. FED’s tapering would drive yields higher in the already fragile US economy putting pressure on US bond prices, resulting in huge mark-to-market losses on bond portfolios. The US debt currently stands at over $17 trillion.

In May 2013, the announcement of the FED’s intention to taper QE created a panic fall in US treasuries, with the yields on US 10-year notes rising above 2 per cent. Treasuries due in 10-years and longer have lost 10.2 per cent this year to 14 November 2013, reveals Bloomberg World Bond Indices.

After taking charge as governor of the RBI in September, Raghuram Rajan has announced various measures to stabilise the currency. The co-ordinated action taken by the RBI and the government has helped control the CAD and has instilled confidence amongst market participants. According to the RBI, the CAD for 2013-14 is expected to remain at about $56 billion, as against the earlier estimates of $70 billion. The RBI has indicated that it is comfortably placed to face QE tapering, whenever it happens, as India has a sufficient pool of foreign exchange reserves to meet the demand for dollars.

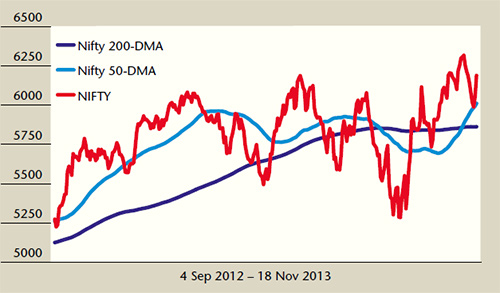

Since this Diwali, Indian markets have taken a breather by correcting over 300 points in the first half of November to sub-6000 levels. Technically, the NIFTY has taken support at about 50 DMA and is now trading comfortably above 50-DMA and 200-DMA, indicating short-term as well as longterm strength in the index. Investors are looking for stability in the markets. We feel Indian markets will remain range bound and consolidate around current levels with an upward bias till the third week of December, when events such as the RBI monetary policy and state election results will take centre-stage and decide the direction of the market.

This article was originally published in Business India Magazine.

Write to us at news@valuelineadvisors.com

Disclaimer: The views expressed in this article are personal and the author is not responsible in any manner for the use which might be made of the above information. None of the contents make any recommendation to buy, sell or hold any security and should not be construed as offering investment advice.