Reversal of interest rate cycle offers a ray of hope for infrastructure sector

Infrastructure is considered as a backbone of any economy, especially for emerging economies like India. Higher spend on the infra projects creates cascading multiplier effect in the economy, driving GDP growth.

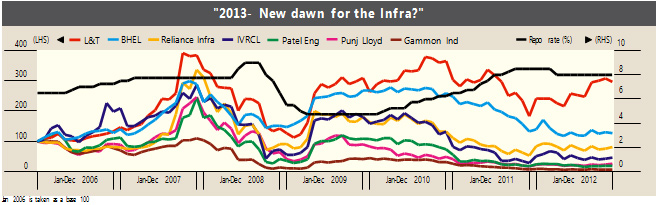

For past few years, Indian economy has been facing various challenges in the form of uncertain economic environment, higher inflation, tightening of monetary policies, depreciating currency, global crisis, worsening fiscal situation slowdowns in reforms and delays in key policy decision making. All these factors have resulted in prolonged soft patch in the infrastructure spending, both by the government and the private sector. The growth in gross fixed capital formation in the economy has consistently witnessed a declining trend during the past few years.

Slower project execution and delays in recovery of receivables has resulted in elongated working capital cycle leading to highly levered balance sheets. A sample analysis of 33 companies across the sector shows debt: equity of over three times on a consolidated basis for 2011-12. Higher operating costs and interest payments have put strain on the margins. For a sector which is capital intensive, increase in borrowing cost hurts projects most of which are funded by banks.

Though difficult times still persist, we believe that the outlook for the sector beyond 2012-13 is brightening up, indicating a reversal in the trend. Not only are monetary conditions likely to improve from 2013-14, but the government is also making pertinent efforts to remove bottlenecks that are delaying infrastructure projects in India.

Positive initiatives by the government – like steps to revive investments in the country with the aim to bring GDP growth back on track, checking of subsidies on petroleum products by hiking fuel prices in the phased manner, restructuring of SEBs, direct monitoring of infrastructure projects by the PMO, and facilitating fund flow for the infrastructure projects are conditions providing an additional tailwind for revival of the sector.

The government has recently cleared way for setting up of National Investment Board (NIB), now renamed Cabinet Committee on Investments (CCI) as a window to grant necessary clearances such as mining leases, forest clearance, environmental management plan and land acquisition for accelerating commencement of mining. This is expected to act as major accelerator for the economy. The XIIth Five Year Plan (2012-17) envisages investments of about $1 trillion in infrastructure projects and is looking for private sector participation to fund half of this through Public-Private Partnership (PPP) model.

Interest rate cycle seems to have peaked with signs of moderation in headline inflation. A large number of the infrastructure companies are highly levered, with 17 out of 33 companies analysed having debt-to-equity of more than two times. Reversal of interest rate cycle will help reduce interest costs and improve cash flow and profitability for these companies. Rationalisation of interest rates is also likely to revive the slowing economy fuelling capex cycle and improving revenue visibility for these companies.

A prolonged soft patch, coupled with lack of positive news, amongst other concerns, has led to most of the mid-cap infra companies quoting much below their historically traded valuations. An analysis of companies in the infrastructure sector shows that 20 out of 33 companies analysed are trading below their book values – out of which 10 companies trade below 0.5 times price-to-book value.

This article was originally published in Business India Magazine.

Write to us at news@valuelineadvisors.com

Disclaimer: The views expressed in this article are personal and the author is not responsible in any manner for the use which might be made of the above information. None of the contents make any recommendation to buy, sell or hold any security and should not be construed as offering investment advice.