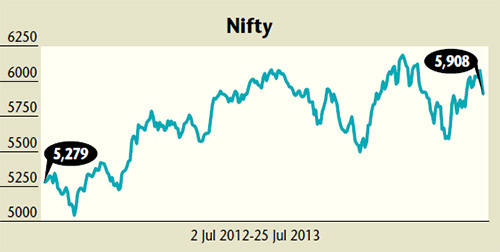

Despite India’s weak macro fundamental factors, NIFTY is trading at 5900 levels

Most of the technical indicators for India’s equity markets at first blush indicate that a bull run has begun. While nifty has held on to its bullish momentum, the mood on the street is grim and full of pessimism or uncertainty. The broader markets are strongly under a bear grip. The macro-economic factors are weak. Political uncertainty is high. The year 2014 is the election year and the financial impact of social welfare schemes such as food security bill on the already weak economy is worrying the markets. The Indian currency has depreciated by over 9 per cent to `59.11 in the last three months and is still looking weak. As per data published by SEBI, FIIs have withdrawn over `18,000 crore from Indian equity markets since 11 June 2013 and over `51,000 crore from Indian debt market since 23 May 2013.

On the face of it, nifty is just couple of hundred points away from its all-time high. However, a strict detailed analysis of the performance of the individual components shows that the nifty performance is not broadbased. It has given a return of 17 per cent in the last one year – between 26 July 2012 and 25 July 2013. During this period, only 18 out of the 50 companies have outperformed the Index. And this has come mainly from sectors such as information technology, fast moving consumer goods (fmcg), pharmaceuticals, automobiles and a select few private-sector banks – where the out-performance has ranged between 3 per cent and 59 per cent over nifty returns.

On the face of it, nifty is just couple of hundred points away from its all-time high. However, a strict detailed analysis of the performance of the individual components shows that the nifty performance is not broadbased. It has given a return of 17 per cent in the last one year – between 26 July 2012 and 25 July 2013. During this period, only 18 out of the 50 companies have outperformed the Index. And this has come mainly from sectors such as information technology, fast moving consumer goods (fmcg), pharmaceuticals, automobiles and a select few private-sector banks – where the out-performance has ranged between 3 per cent and 59 per cent over nifty returns.

The stocks of companies from core sectors of the economy such as metal and mining, engineering and capital goods, construction and infrastructure, public sector banks, and power have lagged behind the nifty returns by a huge margin. The under performance of these stocks has ranged from 2 per cent to 67 per cent.

If one looks beyond the frontline stocks, the pain is even more. The mid-cap and small cap indices have underperformed the nifty in a big way. The cnx Mid-cap and cnx Small Cap Indices have delivered returns of 2 per cent and negative 12 per cent respectively, as against 17 per cent returns by nifty in the past one year. If one looks at all the companies listed on the BSE, only 33 companies are trading at 52-week highs, out of which only 13 are trading at all-time highs. On the other hand, 331 companies are trading at 52-week lows, out of which 99 companies are at all-time lows. Over 62 per cent of the companies listed on BSE are trading below 200-dsma, reflecting the overall bearish mood of the markets.

While the nifty is trading at psychologically strong levels of 5900, the feeling of bull-run in the broader market is completely missing. There is a feeling of despair in the market, with high volatility and sub-optimal returns. The government has taken steps to improve the sentiments and attract investments from foreign investors and has increased fdi limits in various key sectors including telecom, insurance and defence. However, recently announced measures by the rbi to support the sharp fall in the rupee by raising marginal standing facility rates to a record 10.25 per cent and increasing bank rate to the same level have unnerved the markets.

While broader indices are trading at 5900 levels, the core sectors of the economy, such as construction, infrastructure, capital goods, metals, mining, power, etc, are in troubled waters. The economy is going through the painful bottoming out process. The rbi has clearly stated that only reforms can put economy back on track. The government has reiterated its commitment to kick-start delayed projects and has also taken measures to reduce twin deficits and bring stability to the Indian currency. Speedy resolution to issues relating to mining, land acquisition and power sector reforms along with a fall in interest rates will turn the investment cycle giving boost to core sectors of the economy. The large and mid-range companies in these sectors are highly under-owned. They are attractively priced and are trading at distress valuations at the lower end of their long-term averages. The turnaround in these sectors will drive the sentiments higher and result in broad-based rally in the Indian equities.

This article was originally published in Business India Magazine.

Write to us at news@valuelineadvisors.com

Disclaimer: The views expressed in this article are personal and the author is not responsible in any manner for the use which might be made of the above information. None of the contents make any recommendation to buy, sell or hold any security and should not be construed as offering investment advice.