With GDP growth, rupee should strengthen, going forward

Since the third week of May 2013, Indian markets have seen havoc post the US Fed’s initial indication of tapering off QE3. The cnx nifty, which was trading strong at around 6225 levels, has fallen 10 per cent in a month

to 5590 levels. The dollar to rupee, which was steady at about `54.90, has depreciated more than 9 per cent in a month to take the rupee to a low of `60 on 20 June 2013.

FIIs have suddenly turned net sellers, both in Indian equities as well as the debt segment. From 12-24 June, FIIs have net sold equities in the cash segment worth `7,500 crore, and over `30,600 crore from Indian debt markets from 23 May-21 June, putting further pressure on the rupee.

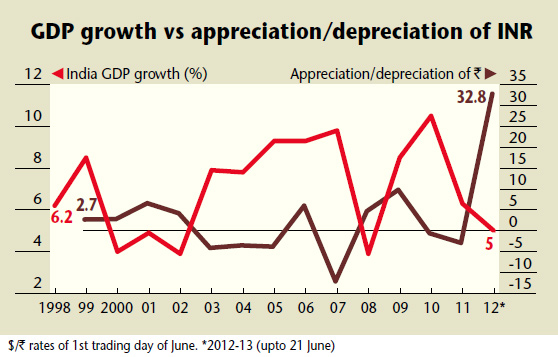

There are various key economic factors influencing the exchange rate, including the economic growth rate (GDP growth), rate of inflation, interest rates, current account deficits, etc. Here, we have tried to analyse how much the GDP growth rate influences the Indian currency. We analysed annual historical time series data on Indian GDP growth rate and dollar/rupee starting 1999. In five out of the 14 instances, annual GDP growth rate has ranged from 3.8 per cent to 5 per cent. In each of these years, when gdp growth was low, the value of the rupee has depreciated against the dollar. In the remaining nine instances, the gdp growth has always remained above 6 per cent, averaging 8.7 per cent during the period.

Again, during six of these nine instances, whenever the gdp growth rate has been more than 6 per cent, the rupee has appreciated against the dollar. Thus, in 11 out of the 14 instances, the currency has moved in sync with gdp growth.

Currently, India is struggling with GDP growth. It grew by 4.8 per cent in Q4 FY13, as against 4.7 per cent in Q3 FY12. This, coupled with the high cad, inflation, and interest rates, is putting pressure on the rupee. As interest rates have peaked and the government has shown seriousness and urgency in tackling the deficit problem, there is a consensus building amongst market analysts that the Indian economy has bottomed out and is ready for a north-bound move, provided the investment environment is revived.

However, the recent announcement of tapering off qe by the US Fed has created panic amongst market participants. In the past couple of years, India’s economic growth has slowed down substantially amid a rise in cad, which was funded primarily through strong FII inflows in the past.

Now, as FIIs have turned net sellers, post the Fed’s announcement, market participants are worried about the funding of India’s cad and its adverse impact on the rupee, which could re-ignite inflationary pressure in the economy and lower the possibility of interest rate cuts. The same was reflected in the Indian bond market, where debt markets hit a lower circuit on 20 June on the back of excessive selling by FIIs and trading had to be suspended for 45 minutes. The only way for the government to resolve this problem on a sustained basis is by a revival of growth in the economy. It has begun to take strong measures to revive growth. However, unless bottlenecks affecting stalled infrastructure projects are cleared and steps are taken to encourage fresh investments, growth may not take off.

While, at present, market participants are looking increasingly worried about funding cad, we believe that tapering off the QE would eventually benefit emerging markets like India, going forward, as it will keep global commodity prices under check, helping revival of growth.

The Indian economy is currently at the tipping point and most forecasts suggest a GDP growth rate of 5.8-6.0 per cent for 2013-14. With the Lok Sabha elections imminent by 2014, the tide will change sooner than later and the revival in investment climate will drive Indian GDP higher to a new trajectory. The sustainable growth in the gdp and the improvement in macro-economic fundamental factors will strengthen the rupee and drive Indian equities to new highs in the coming years.

This article was originally published in Business India Magazine.

Write to us at news@valuelineadvisors.com

Disclaimer: The views expressed in this article are personal and the author is not responsible in any manner for the use which might be made of the above information. None of the contents make any recommendation to buy, sell or hold any security and should not be construed as offering investment advice.