In a sustained bull market, there is a strong possibility of midcap stocks outperforming the large caps

Policy reforms by the UPA government have seen the Indian stock market stage a bounce-back. Beginning September 2012, the stock market has rallied sharply. The fear of sovereign downgrade by the global rating agencies seems to have worked. Though late, the UPA government, led by a renowned economist as prime minister and an expert on commerce and business as finance minister, have shown a strong resolve to pursue reforms and overcome the policy paralysis, even at the cost of letting go the support of its key ally, Trinamool Congress (TMC). The industry and the investors have welcomed the move and have reacted positively to the development.

For the past few months, we have been maintaining our bullish stance on the markets and have been indicating that markets are due for a sharp upward movement, provided the government puts its act together. On many occasions, through this column, we have been positive about the changes at the Centre. Firstly, we had welcomed the change of guard at the finance ministry, which set in the much needed feel-good factor amongst the investors. When the government had taken a soft stand on the retrospective taxation and GAAR issues, the markets had cheered the move.

In line with this positive sentiment, we had talked about the possibility of the strong rally in the Indian equities, when the NIFTY breached 200-day moving average. Given the state of high pessimism in the markets and with the talks of positive policy action from Prime Minister Office (PMO), we felt that the change in trend was imminent. Since then, the NIFTY has rallied from around 5200 levels to over 5700 levels and it continues its north bound journey.

Then, we spoke about how Indian stock market performance was directly correlated with the FII flows. The constant inflow of FII investments into the Indian equities further strengthened our belief that markets would break out on the upside. In September alone, the FIIs have net invested over `20,700 crore into the Indian equities. Year-to-date, FIIs have net invested over `84,000 crore.

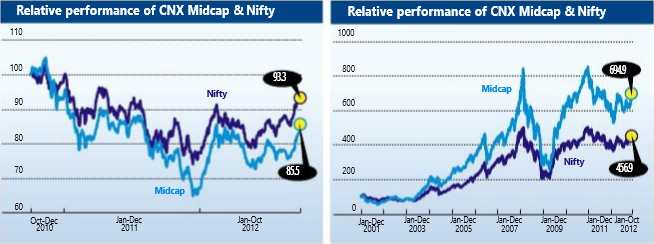

Now, in the last one month, since 3 September 2012, the NIFTY has moved up from 5253 levels to 5731 levels – an increase of 9.1 per cent. Similarly, CNX Midcap Index have moved up 12.7 per cent. During the last two years of economic downturn, starting October 2010, the NIFTY has fallen 6.7 per cent, whereas CNX Midcap Index has fallen 14.5 per cent. However, if one looks at longer term returns starting January 2001, CNX Midcap Index has given annualised returns of 17.5 per cent, as against 13.5 per cent returns by the NIFTY (see chart).

It is a well known fact that midcap stocks are more volatile than its large-cap peers. The mid-cap stocks, which are hammered out of shape during the last two years, are currently available at reasonable valuations. Going forward, as economy recovers, and in the event of sustained bull-run, there is a strong possibility of midcap stocks outperforming the large caps by big margin.

This article was originally published in Business India Magazine.

Write to us at news@valuelineadvisors.com

Disclaimer: The views expressed in this article are personal and the author is not responsible in any manner for the use which might be made of the above information. None of the contents make any recommendation to buy, sell or hold any security and should not be construed as offering investment advice.