During the phases of strong FII inflows, markets perform well.

Liquidity drives markets, and the flow of funds drives liquidity. While it is important to have strong domestic participation, the money pumped in by foreign institutional investors (FIIs) adds fuel to recovery in the market. India opened its stock market to FIIs two decades back (September 1992) and since then, portfolio investments from FIIs are being channelised into the domestic equity market. There have been some jerks – peak and fall in real numbers.

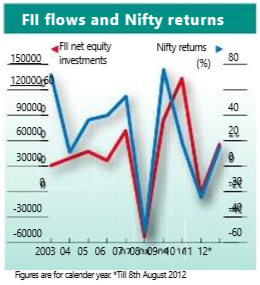

Overall these FIIs have gained a significant role in Indian stock markets. Volatility in market indices is clearly influenced by FII flows. To prove this point, take the broad index – the NIFTY and its movement over the last decade – and plot it against the annual FII flow into the Indian market (see chart). An analysis reveals that during the 10-year period, the NIFTY has danced to the tune of FII investments. They have been in sync.

The simple observation of the data points tells us that during the phases of strong FII inflows between 2003 and 2007 and between 2009 and 2010, markets had performed extremely well. However, with the reversal of money from FIIs in the years 2008 and 2011, markets had collapsed. This shows that the performance of Indian equity markets is directly linked to FII flows.

Circa 2012. Since the beginning of the year, FIIs have been on a buying spree in Indian equities. Despite global uncertainties and concerns over a slowing domestic economy, FIIs have invested over `55,000 crore ($11 billion) into Indian equities between January and August 2012 (till 8 Aug). This has resulted in a strong up-move in the market indices. NIFTY has moved-up strongly from 4624 levels at the end of December 2011 to 5338 levels in August 2012, after touching 52-week highs of 5607 levels in February 2012.

FIIs have invested over `43,900 crore into Indian equity markets in the first quarter ended March 2012. Subsequently, with the announcement of controversial General Anti-Avoidance Rules (GAAR) and retrospective taxation by ex-finance minister Pranab Mukherjee, this has been the biggest dampener of sentiments, resulting in FII outflows to the tune of `1,957 crore in the second quarter ended June 2012.

FIIs have invested over `43,900 crore into Indian equity markets in the first quarter ended March 2012. Subsequently, with the announcement of controversial General Anti-Avoidance Rules (GAAR) and retrospective taxation by ex-finance minister Pranab Mukherjee, this has been the biggest dampener of sentiments, resulting in FII outflows to the tune of `1,957 crore in the second quarter ended June 2012.

Enter into the third quarter of the year, with the government’s softening stand over GAAR and retrospective taxation issues, FIIs have turned positive with net investments of over `13,000 crore put back into the Indian stock market between July and August (till 8 Aug). This is despite major concerns over the country’s fragile economy and drought- like situation. Clearly drought doesn’t seem to be a matter of concern for them! FIIs have been investing aggressively in the Indian markets on the expectations of announcement of concrete steps to fix fiscal deficit and positive policy initiatives from the government during the ongoing Monsoon Session of Parliament.

Going by the past, on various occasions FIIs have played an important role in building up India’s forex reserves which have enabled a host of economic reforms. They see a country’s up-cycle much earlier than others. Once they come in, the secondary market followed by the primary market picks up steam, money flows into growth companies and the economy picks up.

Such is their position that FIIs are occupying an important seat in the country’s economic growth despite the current sluggish domestic sentiment. FIIs strongly influence short-term market movements during bear markets. Even with strong FII flows, Indian markets are currently trading range-bound. This is mainly due to continuous selling by domestic institutions. It will be interesting to see if FIIs will continue to pump in money, given the bad shape of macro-fundamental factors. The historical trend and the high positive correlation between FII flows and performance of the NIFTY provide hope that markets will eventually breakout on the upside. This can happen only if there are more positive moves from the government’s side.

This article was originally published in Business India Magazine.

Write to us at news@valuelineadvisors.com

Disclaimer: The views expressed in this article are personal and the author is not responsible in any manner for the use which might be made of the above information. None of the contents make any recommendation to buy, sell or hold any security and should not be construed as offering investment advice.