Markets to trade with positive bias prior to elections

Globally, elections are key events and are followed minutely by the investors and the market participants. Markets always hope for stable and progressive governments. As the general elections near, there is a period of nervousness in the markets. In India, the upcoming general elections are scheduled in May 2014. As the current year is a pre-election year, all the political developments are tracked closely by the market participants.

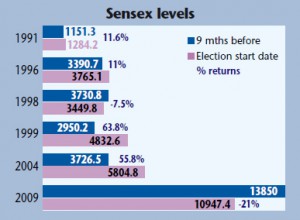

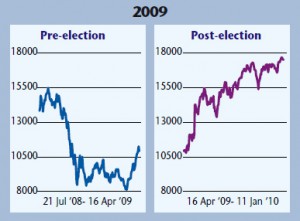

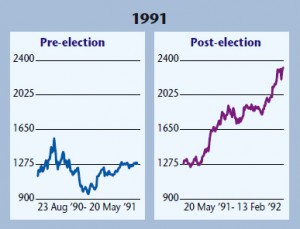

To understand the impact of general elections on equity markets during the pre-election year, we analysed the equity market performance during previous pre-election years starting 1991. India has gone through six elections between 1991 and 2009. We have analysed nine months before and after the elections period.

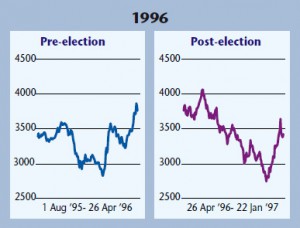

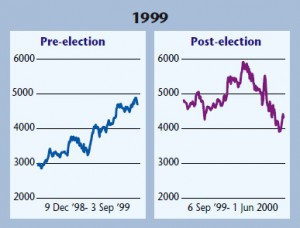

During most of the pre-election years, equity markets have traded flat with positive bias, except for the year 1998, when the markets traded flat with negative bias as there was extremely uncertain political climate due to unstable government at the Centre.  Even the 2009 pre-election period had witnessed highly volatile markets with downward bias. Though we feel, this could be considered an aberration, as all the global markets witnessed turbulent meltdown due to the US sub-prime crisis.

Even the 2009 pre-election period had witnessed highly volatile markets with downward bias. Though we feel, this could be considered an aberration, as all the global markets witnessed turbulent meltdown due to the US sub-prime crisis.

In majority of the cases, markets have given positive returns during pre-election years. After a strong 2012, the year 2013 has been disappointing mainly due to uncertainty in Europe, fear of North Korean war and fear of early elections.

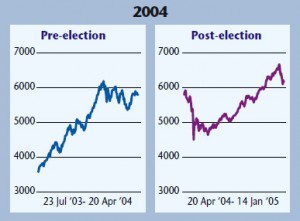

We believe the current period could be correlated to pre-2004 election period when the NDA government at the Centre had initiated fresh rounds of reforms starting first quarter of calendar year 2003 after long period of slower economic growth and lacklustre markets. Currently, we can see the similar trend. After an extended period of slower economic growth, the UPA government has finally come out of the hibernation mode and has initiated fresh rounds of reforms starting last quarter of the calendar year 2012.  While the reforms are still to show any significant impact on the economic growth, as the election period nears, the pick-up in government spending will lead to revival in the economy.

While the reforms are still to show any significant impact on the economic growth, as the election period nears, the pick-up in government spending will lead to revival in the economy.

Historically, the pre-election years have witnessed drastic jump in government expenditure. The spending in public capex could also trigger fresh round of capex cycle, which could drive economy. Also, as the political parties prepare for the elections, the election-linked spending by the political parties and the spending by election commission could also drive momentum in the economy.

This article was originally published in Business India Magazine.

Write to us at news@valuelineadvisors.com

Disclaimer: The views expressed in this article are personal and the author is not responsible in any manner for the use which might be made of the above information. None of the contents make any recommendation to buy, sell or hold any security and should not be construed as offering investment advice.