The steep depreciation of rupee has created havoc in the Indian financial market

After a long span of over two-and-a-half years, the Nifty regained its intermediate high of over 6100 levels in the last week of May 2013. Between mid-2012 and May-2013, dollar/rupee was trading in the broad range between 53 and 56 levels. Despite weak macro factors, with high inflation, weak investment climate, and ballooning twin deficits, there was a sense of optimism prevailing in the markets. Analysts were expecting a turnaround in the economy, driven by fall in interest rates, supportive government actions towards revival of investment climate, and strong fii inflows. Yields on long term bonds were falling and Indian bond markets were buoyant with liquidity.

This optimism lasted till the US Federal Reserve announced the possibility of tapering of Quantitative Easing, driven by better-than-expected revival of the US economy. Yields on US bonds, which were at historical low levels suddenly shot up. This development has created havoc in the financial markets of various emerging economies, including India. The foreign money started flowing out of emerging markets into the US.

The currencies of various emerging economies, including India, have depreciated sharply, causing a sense of panic in the minds of the investors. The fall in currency is particularly more severe for countries with higher current account deficits. The Indian rupee has depreciated by over 20 per cent against US dollar in a short span of just four months since May 2013 to cross 68 levels. Since Nov 2010, USD/INR has depreciated 33 per cent from `43.2 to `65 per dollar.

In order to support the falling rupee, the RBI and government announced several measures since June 2013. The RBI tightened liquidity, raising both marginal standing facility and bank rate from 8.5 per cent to 10.5 per cent. It has capped daily lending under liquidity adjustment facility to 1 per cent of the bank book and announced bond sales through open market transactions. It has raised the daily balance requirement under CRR to 99 per cent from 70 per cent. These measures have tightened the liquidity in the economy and have resulted in a sharp rise in bond yields. It has announced measures to discourage imports and boost exports.

The RBI has also reduced the amount local companies can invest overseas without needing approval to 100 per cent of their net worth from 400 per cent earlier. It has reduced the remittance limits by the residents to $75,000 per year from $2,00,000 earlier. These restrictions have created further panic among investors about possible capital controls by the government to support the currency.

All these measures have resulted in an increase in bond yields. Yields on 10-year government bonds have shot up to over 9.3 per cent, almost at same levels as during the Lehman crisis. This shows the level of panic in the bond markets.

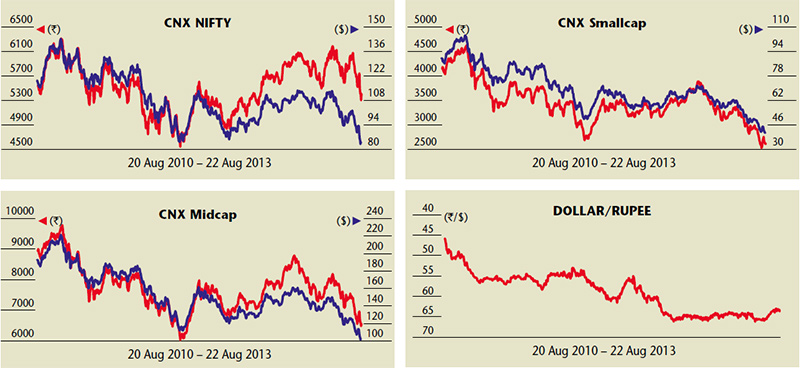

Indian equity markets have also suffered huge FII outflows since May 2013. The Nifty has fallen from 6100 levels since the end of May 2013 to around 5300 levels on 21 August 2013, falling more than 13 per cent in the span of just three months. While the Nifty has fallen by around 13 per cent in rupee terms in three months since mid-May 2013, it has fallen by over 26 per cent in dollar terms. In dollar terms, the Nifty is now trading at December 2011 lows. The situation is even worse for mid-cap and small-cap stocks.

The CNX Midcap index has fallen around 20 per cent in rupee terms since mid-May 2013 and by 32 per cent in dollar terms. Similarly the CNX Small cap has fallen around 23 per cent in rupee terms and over 34 per cent in dollar terms. In dollar terms, CNX Mid Cap and CNX Small Cap are currently quoting 9 per cent and 19 per cent below the December 2011 lows respectively, when Nifty made lows of 4550 levels.

This shows the magnitude of correction which has happened in The volatility has shot up with India VIX index reaching 28 levels, similar to December 2011 levels. All these factors indicate a crisis-like situation in the Indian economy, with all the productive asset classes like equity and debt facing the brunt of this situation. While India’s Forex situation is much better today than in 1991, the mood in the economy is similar to what was seen during 1991 currency crisis.

There is fear that the RBI may increase interest rates to support the rupee, which can adversely impact the already fragile economy. Spending on social programmes such as the Food Security Bill, which proposes to cover over two third of the population, will put further pressure on government finances. The RBI has already warned the government on the viability of the food security bill, asserting that the rise in subsidies would hamper investments and add to the fiscal pressure.

During this crisis like situation, there is a need for out-of-box thinking to reverse the downfall. It is extremely important that the RBI and government act sensibly towards a resolution of the crisis, avoid wasteful expenditure, focus on productive spending and take measures to boost growth.

This article was originally published in Business India Magazine.

Write to us at news@valuelineadvisors.com

Disclaimer: The views expressed in this article are personal and the author is not responsible in any manner for the use which might be made of the above information. None of the contents make any recommendation to buy, sell or hold any security and should not be construed as offering investment advice.