Retail to the fore.

As we have been stating through our columns in this magazine, the Indian markets have now stabilised after completion of the US mid-term elections. Crude price, which was rallying due to geopolitical factors, has now corrected sharply, with Brent Crude falling by 23 per cent in just 30 days after hitting highs of $86.29 on 03 October. The fall in the rupee has also been contained, with the currency now reversing the trend to 72.16, after hitting all-time-lows of 74.34 on 9 October. The pressure of the ongoing trade war between China and the US has eased significantly, bringing stability to the global trade environment.

Macro headwinds, which were affecting Indian equities, are behind us. The tailwinds, which are now emerging from the improved macros, will eventually drive markets even higher. As against the concerns of the rising inflation, the data announced for October 2018 is below the consensus estimates and is well within the RBI’s comfort zone.

The inflation data and the emerging trends in the economy strengthen the case for an interest rate cut, as against the consensus view of increasing interest rates. Today, India has one of the highest real interest rates among the large economies. The reversal in bond yields should result in a strong bond rally and a recovery of losses on the bond portfolios.

Investors are primarily concerned about the tight liquidity in the Indian financial sector. The banking system is unable to provide lending due to higher NPAs and capital constraints. The NBFC sector, which was providing lending support to the economy, too has started facing liquidity constraints after the IL&FS default. There is a systemic risk of contagion spreading on to the other sectors and asset classes, which is the biggest near-term concern faced by the markets. The government and RBI are closely monitoring the situation.

With the state and general elections round the corner, political uncertainty too is keeping the markets nervous. The ruling BJP government had recently lost seats in the Karnataka by-polls. The markets will keep a close eye on any fresh trends emerging from the state election results, which are scheduled to be announced on 11 December.

An analysis of historical trends of depreciating Indian currency in the pre-election year and returns provided by NIFTY in 12-24 months after the elections provide an interesting insight. That is, every time the rupee has depreciated by over 10 per cent prior to the election year, the Indian markets have tended to shoot up sharply in the next 12-24 months.

For instance, before the 2009 elections, the rupee had depreciated by over 30 per cent between January 2008 and March 2009. This was followed by a sharp rally of over 75 per cent in NIFTY between March 2009 and June 2009 and a huge 145 per cent between March 2009 and November 2010.

Similarly, prior to the 2014 elections, the rupee fell by over 25 per cent between May 2013 and September 2013. This was followed by a 70 per cent rally in NIFTY between September 2013 and January 2015.

General elections in India are due in 2019 and the rupee has already fallen by over 17 per cent during January-October 2018. It will be interesting to see if history repeats itself in 2019.

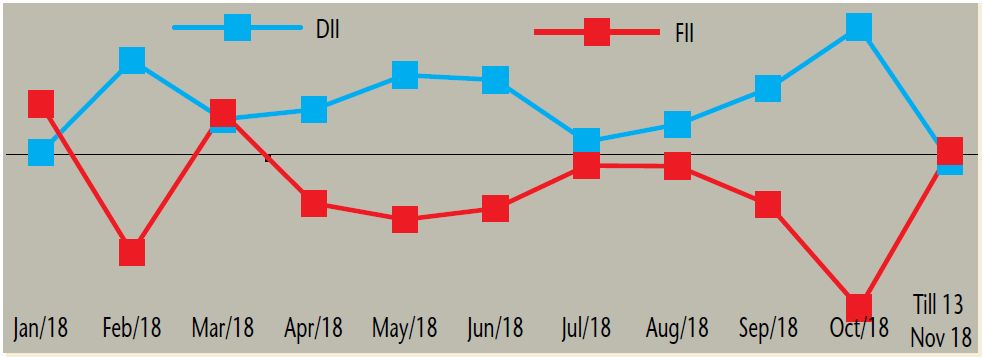

The FIIs have been sellers of Indian equities since February 2018, the sales exceeding Rs85,000 crore in the cash market during this period. The DIIs, on the other hand, continue to be net buyers of Indian equities and have invested over Rs105,000 crore during this period.

After the ruthless selling of September and October, the markets have seen a comeback from the first week of November 2018. NIFTY 50 is now nearing 200-DMA, which currently stands at 10700-10800. Monthly inflows through mutual fund SIPs have continued to rise, despite higher volatility and a sharp correction in equities in this calendar year. The total monthly inflows through SIPs have now touched all-time highs of Rs7,985 crore in October 2018 – up 42 per cent year on year. The trend is likely to continue, as more domestic savings get channelised into financial markets.

The India growth story is extremely buoyant and resilient to headwinds faced in the short term. Reforms undertaken by the government in the past few years have further strengthened the India growth story. Years 2019 and 2020 are likely to be the magical years for Indian equities and have the potential to surprise everyone on the upside.

This article was originally published in Business India Magazine.

Write to us at news@valuelineadvisors.com

Disclaimer: The views expressed in this article are personal and the author is not responsible in any manner for the use which might be made of the above information. None of the contents make any recommendation to buy, sell or hold any security and should not be construed as offering investment advice.