Improving fundamentals to drive markets higher

The CNX-NIFTY touched an all-time high of 8173 on 8 September 2014. Since then the markets are consolidating between 7700 and 8200, taking a breather at current levels. The consolidation in the Indian market is mainly driven by ongoing correction in the global indices due to various global factors. During this period Indian equities have outperformed global peers showing signs of strength. There are various factors which support this outperformance and strength shown by the Indian equities.

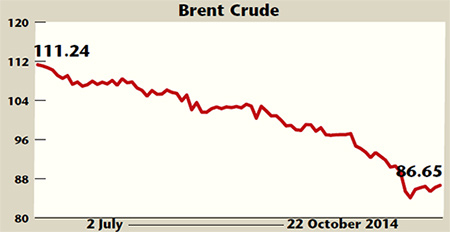

One of the most important factors is the improving fundamentals and fall in inflationary pressure in the economy. Inflation has dropped to multi-year lows. The price of Brent Crude has fallen sharply by over 24 per cent from $111 per barrel in July 2014 to $84 per barrel in October 2014. The falling crude price will improve India’s fiscal position with a drastic fall in the import bill and will further result in a fall in inflationary pressure. This fall in inflationary trends may prompt the Reserve Bank of India (RBI) to start lowering interest rates much earlier than anticipated. Technically Brent Crude is now trading in the bearish zone and prices are expected to remain soft in the medium term.

The trend of falling crude oil prices has allowed the government to take strong the decision of diesel price deregulation which is a big reform from the market’s perspective. Diesel prices were lowered sharply by over `3 per litre, which will help in easing of the inflationary trend. This strong move shows that the government is serious about the implementation of key reforms which will eventually help reduce subsidies and improve the fiscal position.

The political landscape in the country is changing. Strong performance by the Bhartiya Janata Party (BJP) in the recent state elections further provides vigour to the ruling party at the Centre to carry on with the strong reforms and focus on good governance. The presence of the BJP government at the Centre and in state will improve coordination for development and growth. The BJP is consolidating its power in politically important states. The recent performance by the BJP in Haryana and Maharashtra will help raise the Rajya Sabha tally.

Retail participation, which was lukewarm in the market, is steadily increasing. Equity schemes of mutual funds have seen an increase in net inflows of over `30,000 crore between June and September 2014. Retail investors are gaining confidence and have started making a comeback with a steady increase in their equity allocation.

The RBI is building foreign exchange reserves to absorb volatility in currency arising from global shocks and the possibility of a rise in the US interest rates. India’s forex reserves as on 17 October 2014 stood at a $312.7 billion. Having strong forex reserves will not only help India withstand any global shocks, but also provide stability to the Indian currency.

The government has recently unveiled labour reforms to make it easier to do business in India and boost global investor sentiment by easing the compliance burden and ushering in transparency. In the first major shuffle of the top civil servants since the formation of the new government, finance secretary Arvind Mayaram was replaced with Rajiv Mehershi, who is currently the chief secretary of Rajasthan. Mehershi is said to be the brains behind the key labour reforms in Rajasthan.

The government is also expected to carry out its first major Cabinet expansion before Parliament’s winter session begins at the end of next month. There are expectations of big bang reforms coming from the government in the next few months. The government will introduce a revised GST Bill in the forthcoming winter session of Parliament. And the government aims to implement the GST from 1 April 2016.

These factors will drive Indian markets to new highs, with the NIFTY touching 9000 levels soon. This short-term blip is the best opportunity for investors to invest in the markets for the next few years.

This article was originally published in Business India Magazine.

Write to us at news@valuelineadvisors.com

Disclaimer: The views expressed in this article are personal and the author is not responsible in any manner for the use which might be made of the above information. None of the contents make any recommendation to buy, sell or hold any security and should not be construed as offering investment advice.