Falling interest rates will benefit the auto sector

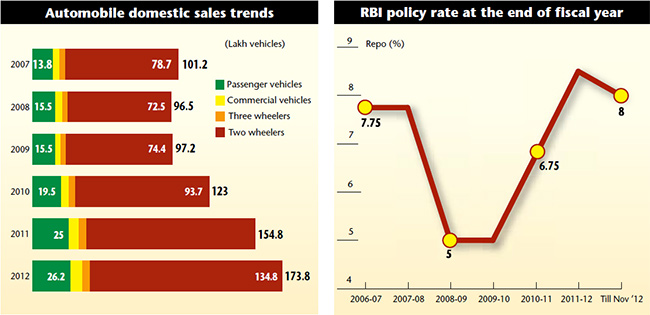

Interest rates are one of the major drivers of any economy, affecting the investment and consumer spending decisions, especially for big ticket items like automobiles and consumer durables. On the domestic scene, over the past couple of years, the Reserve Bank of India (RBI) has hiked the interest rates in the economy in its war against inflation. In the short span of about 19 months (March 2010 and October 2011) alone, rbi has hiked repo rates 13 times, by 350 basis points (bps), from 5 per cent to 8.5 per cent, before finally bringing it down to 8 per cent in April 2012.

The Indian automobile industry, like any other interest-rate-sensitive industry, is bearing the brunt of these sharp interest rate hikes. Most automobile sales in India take place on credit. The interest rate hikes have resulted in a significant increase in the borrowing costs for the consumers especially at a time when the economy has contracted sharply. The increase in fuel prices has further dampened the demand.

The impact is clearly visible by way of a slowdown in domestic sales growth. The domestic automobile sales in the year 2011-12 grew at just 12.2 per cent after two years of over 25 per cent growth in 2009-10 and 2010-11. During April-October 2012 period, domestic auto sales growth slowed to just 5.3 per cent year-on-year (y-o-y). The Society of Indian Automotive Manufacturers (SIAM) has further scaled down its 2012-13 growth forecasts for the industry to just 5-7 per cent.

The demand for the automotive industry is generally seen to be higher during the festive season. This year’s festive season has brought some cheers to the auto industry, where most of the auto companies showed strong growth in sales. Overall automobile sales volumes increased by 14.8 per cent in October 2012.

Historically, the Indian auto industry has shown tremendous growth during the low interest rates periods. Recently, RBI has indicated that the interest rate cycle may have peaked. It is keeping constant vigil on the growth rates and the inflation in the economy. It is just a matter of time before interest rates starts falling. With significant slowdown in fixed capital formation in the economy, recent GDP growth slowing to sub 6 per cent levels and WPI inflation number moderating, there is mounting pressure from various industry bodies and the government to cut interest rates. This will drive the growth in auto sector albeit with some time lag.

This period of high interest rate cycle provides an opportunity for genuine long term investors to take exposure to the sector to benefit from the fall in interest rates.

This article was originally published in Business India Magazine.

Write to us at news@valuelineadvisors.com

Disclaimer: The views expressed in this article are personal and the author is not responsible in any manner for the use which might be made of the above information. None of the contents make any recommendation to buy, sell or hold any security and should not be construed as offering investment advice.